#0002 Marc Andreessen

We break down the interview with Marc Andreessen

Billionaire Investor

Clips used under fair use from JRE show #2234

Show Notes:

https://en.wikipedia.org/wiki/David_Horowitz#Controversy_and_criticism

https://apnews.com/article/fact-check-illegal-2200-payment-government-821946727757

https://bsky.app/search?q=there+are+only+two+genders

Intro Credit - AlexGrohl:

https://www.patreon.com/alexgrohlmusic

Outro Credit - Soulful Jam Tracks: https://www.youtube.com/@soulfuljamtracks

Press play and read along

Transcript

Speaker 1 Today,

Speaker 1 in 2013,

Speaker 1 I did the vulnerability.

Speaker 1 Video, like,

Speaker 1 obtain Wi-Fi in Mazuin with local con ATNT Fiber with Olfi. ATNT connected the change.

Speaker 1 ATNT Fiberteen is connected to limited errors.

Speaker 3

Lessee cannot claim EV incentive on personal tax return. Consult a tax professional for details and eligibility requirements.

Restrictions apply. Contact your dealer for details.

Offer ends 930.

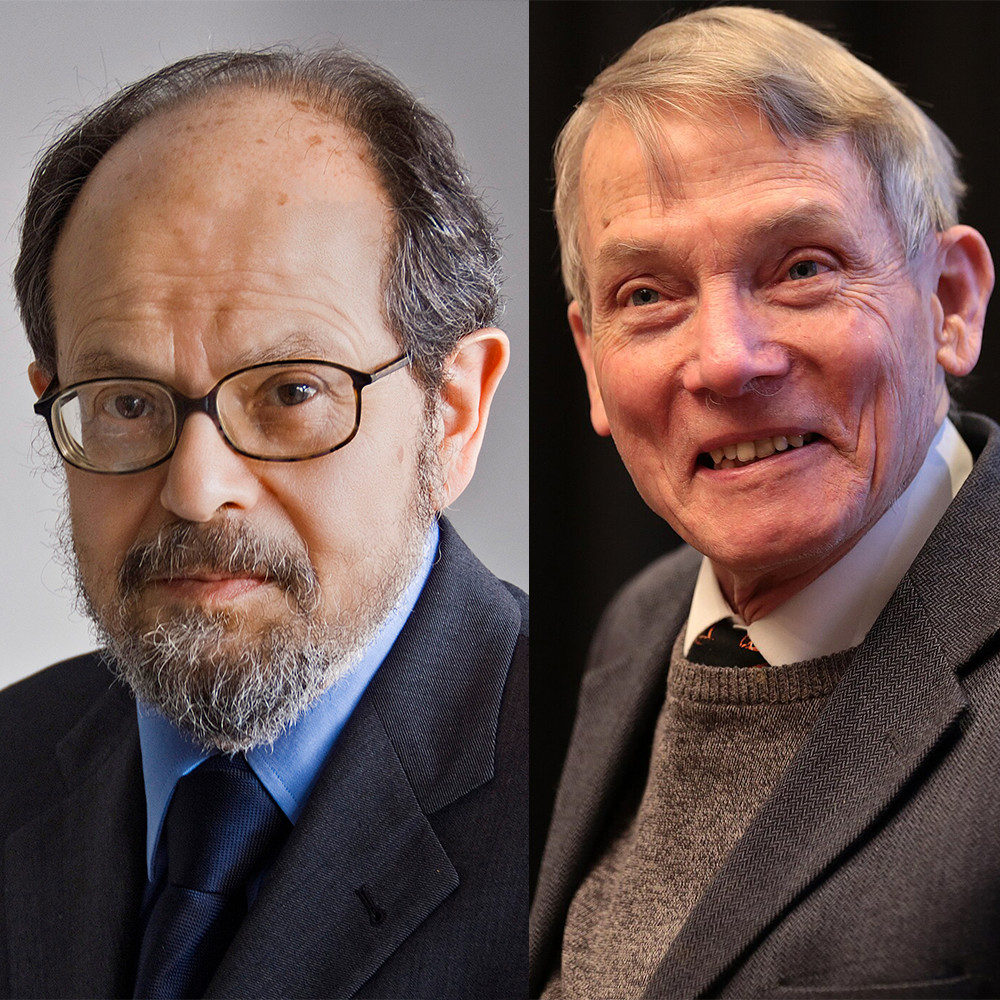

Speaker 2 On this episode, we cover the Joe Rogan Experience, episode number 2234, with billionaire investor Mark Andrierson. The No Rogan Experience starts now.

Speaker 2 Welcome to the show, and thank you for joining us. I'm Michael Marshall and I'm joined by Cecil Cicerello and we are here to talk about Joe Rogan.

Speaker 2 So Cecil, we're two people with no previous Rogan experience. Why are we doing this?

Speaker 4 Well, okay, so Joe Rogan is like without a doubt, one of the most listened to people on the planet. His show reaches far more people than even traditional broadcasting does.

Speaker 4 And his show sort of features this free-flowing conversations, and they influence millions.

Speaker 2 Right, right. And the thing is, he's also someone who comes in for like a lot of criticism for some of those conversations that take that have taken place in his show.

Speaker 2 And a lot of that criticism, it probably comes from people who, like us, had never really ever listened to Rogan, apart from like, you know, we'll see the odd out-of-context snippet on social media, but we won't see that.

Speaker 2

One of the whole thing. Yeah.

So we figured we'd actually listen to Rogan and then try to set the record straight if we can.

Speaker 2 So today we're going to be covering Joe's November 2024 interview with Mark Andreessen. So how did Joel introduce Mark in the show notes?

Speaker 4 So the show notes say that Mark Andreessen is an entrepreneur, investor, and software engineer.

Speaker 4 He is a co-creator of the world's first widely used internet browser, Mosaic, which eventually became Netscape Navigator, co-founder and general partner at the venture capital firm Andreessen Horowitz, and the co-host of the Ben and Mark show podcast.

Speaker 4 He gets second billing on that, I guess.

Speaker 2 Yeah, not a show I was aware of. So now that you've had a chance to actually Google who he is, is there anything you feel that Joe left out about his guest?

Speaker 4 Well, so a couple of things, Mike, you know, funny you should ask. A couple of things come up here.

Speaker 4 Andreessen is a mega donor to the political super PAC and pro-cryptocurrency advocacy group Fair Shake. And he's also one of the largest investors in crypto startups in America.

Speaker 4 The other thing that I think is very important to this conversation, Andreessen's net worth, estimated 1.7 billion US dollars.

Speaker 2 Yeah, that feels kind of relevant and it will be very relevant to what we want to talk about.

Speaker 2 So the thing is, for those uninitiated with the Joe Rorgan experience, his show is, as you say, they've got this kind of stream of consciousness structure.

Speaker 2 And this episode in particular covers conspiracy theories about the failed assassination of Trump, social media censorship, the Twitter files, blue sky, election campaign funding, Robert F.

Speaker 2 Kennedy Jr., pharmaceuticals, Tucker Carlson being metaphorically attacked by apparently a literal demon, woke ideology, how great Elon Musk is, criticism of the Democrats, philanthropy, feminism, and trans people.

Speaker 2 And like, it's fair to say there's a lot we could dig into about any one of those topics.

Speaker 2 But for the for the course of this episode, we wanted to really focus in on Mark and George's conversation, which comes about halfway through on regulation and banking. All right.

Speaker 4 Well, let's get into the main event. event.

Speaker 4 This portion of the Joe Rogan program has been shared hundreds of thousands of times. It's been amplified by people like Elon Musk on Twitter.

Speaker 4 And there's been blog posts written, lots of them on Substack and other places. And then even news outlets have quoted Mark Andreessen in this particular segment on Joe Rogan.

Speaker 2

Oh, yeah, this whole segment really, really took off. This was everywhere.

It was very hard to miss.

Speaker 4 Yeah. You're absolutely right.

Speaker 4 And we're going to play just a few of these clips here from this segment, and we're going to try to break down what they're talking about and then see if they're doling out any misinformation here.

Speaker 4 This first clip is really just talking about

Speaker 4 the federal agencies that exist and what those federal agencies do. These are regulatory agencies.

Speaker 5

Elon explained that there's more agencies than there have been years of the United States. Correct.

Yeah, 450 federal agencies and two new ones a year.

Speaker 5 And then my favorite twist is we have this thing called independent federal agencies.

Speaker 5 So, like, for example, we have this thing called the Consumer Finance Protection Bureau, CFPB, which was the sort of Elizabeth Warren's personal agency that she gets to control.

Speaker 5 And it's an independent agency that just gets to run and do whatever it wants, right? And if you read the Constitution, like there is no such thing as an independent agency, and yet there it is.

Speaker 5 What does her agency do? Whatever she wants. What does it do, though? Basically,

Speaker 5 terrorize financial institutions,

Speaker 5 fintech,

Speaker 5

prevent new competition, new startups that want to compete with the big banks. Oh, yeah, 100%.

How so? Just by terrorizing anybody who tries to do anything new in financial services.

Speaker 2

Right. So when I hear that, the first thing that strikes me, you know, he's saying there's 450 agencies.

That's brought up as a big, kind of scary number.

Speaker 2 But when I hear that, I think, well, actually, is 450 agencies that big a deal? We're meant to think it is, but is it that big a number?

Speaker 2 And if it's not that big a number, why are they raising it here? What do they want you to think? And so I started thinking about how do I figure that out?

Speaker 2 Well, I thought, well, as a rough measure, what the USA has something like 340 million people, something like that.

Speaker 2 So even on a per capita basis, that's about three quarters of a million people per agency, which doesn't seem wild to me.

Speaker 2 It's just that I'm against, I'm very much against government blood, don't get me wrong. And I'm sure some of those things can be trimmed down and made a bit smaller.

Speaker 2 But that 450 number, it might mostly be a function of the fact that America is really, really big and therefore takes quite a lot of people and a lot of like different departments to run it.

Speaker 4 When you say America is very big, I actually did a little bit of searching to figure out like what, what are we talking about here? And America is,

Speaker 4 it has 9,833,000 square kilometers, right? So you mentioned the population, we talk about the size.

Speaker 4

Even just a small department like the Department of Labor, the Department of Labor has 15,300 people working for them. And what do they do? Well, they enforce labor laws.

They help veterans get jobs.

Speaker 4

They help pensioners get benefits that they deserve. They run workers' compensation programs for people injured at work.

They litigate against employers for and on behalf of workers.

Speaker 4 They have compliance office that, so companies that work with the federal government are also following very specific rules. They work with the disabled to help them get work.

Speaker 4

They run OSHA, the Occupational Safety and Health Administration. And then they have a separate one for mining, the Mining Safety and Health Administration.

They fight fight for workers' benefits.

Speaker 4 They do a lot of different things for workers in the United States.

Speaker 2 Yeah. And the thing is, if you're going to cut some of those 450 agencies, you've got to ask yourself, well, which of those things do you want to not happen?

Speaker 2 So do you not want pensioners to get benefits? Is that one of the agencies you're going to cut? Or do you not want veterans to get jobs?

Speaker 2

Or do you not want consumers to be protected against banks that are taking risks? Because that's what he's talking about. He's talking about the CFPB.

Now, he singles that one out.

Speaker 2 I don't think it's a coincidence that he picks on that one and we'll stick with that one for a while.

Speaker 2 But the CFPB was brought in after the 2008 financial crash, when a lot of people lost their homes because banks and real estate agents and various things in that kind of sector were taking risks that were unsustainable.

Speaker 2

And those risks did not pay off. And it wasn't the bankers who lost the money, lost their life savings there.

It was the average people. And that is what the CFPB was brought in to stop.

Speaker 2 It wasn't a government agency that caused that crash, but it's a government agency that is set up to try and prevent that next crash happening. And that, I think, is what Mark's got in his

Speaker 2

line of sight. The other thing that struck me when he's talking about that 450 agencies is, let's take this to a world that Mark knows.

And let's talk about a big tech company.

Speaker 2 How many departments are there with inside of Google?

Speaker 2 Not even just like in terms of like Fitness and Twitter.

Speaker 2

Go across the Google. Google owns YouTube.

Google's got Gmail. It's Drive.

It's got Google Docs. How many departments are behind each one of those products?

Speaker 2

Like, I reckon in Google, you're going to have have 30, 40, 50 departments, something like that. Maybe, maybe, you know, something in that kind of bracket.

That's one company.

Speaker 2

We're talking about America. America is much, much bigger than that.

So it's just not an unreasonable number to me.

Speaker 4 Yeah, I want to talk. I want to scroll back just for a second about government money because you're talking about the CFPB and how

Speaker 4 the financial crash of the housing market really caused a lot of problems. And we're talking, one of the main portions of this is we're talking about government money.

Speaker 4 One of the things is we're talking about government money.

Speaker 4 and that means money that belongs to, you know, not you, Marsh, because you're a UK citizen, but me, you know, belongs to me and other people that live in the United States.

Speaker 4 And we put all that money into the government and we're saying there's a lot of government bloat and there's a lot of government money going out.

Speaker 2 Well, what happened during that crash?

Speaker 4 We bailed those banks out. We gave those banks

Speaker 4

almost a trillion dollars, I think it was. It's an intense amount of money to bail those banks out so they didn't fail.

That was our money, right? We gave that money to them.

Speaker 4 And then we created an agency that said, we don't want to see that happen anymore. We don't want to just have big banks build this giant clip and then jump off it.

Speaker 4 And then we, the American people, have to throw them a money parachute every time. And so

Speaker 4 we created an agency to try to stop that.

Speaker 4 And now this is the agency that they're targeting because they want to make sure that they have as many cliffs as possible that are reinforced with the safety net of the United States taxpayer.

Speaker 2 Yeah, yeah, absolutely.

Speaker 4 So here's the next clip. Now, this is a clip talking about debanking.

Speaker 5 Can you give me an example?

Speaker 5

You know, debanking. This is where a lot of the debanking comes from is these agencies.

So de-banking is when you as either a person or your company are literally kicked out of the banking system.

Speaker 5

Like they did to Kanye. Exactly.

Like they did to Kanye.

Speaker 5

My partner Ben's father has been debanked. Really? We had an employee who...

For what?

Speaker 5 For having the wrong politics.

Speaker 5 For saying unacceptable things.

Speaker 4 Marsh,

Speaker 4 was Kanye debanked?

Speaker 2

Nope. No, he wasn't.

So that was something that was spread around online.

Speaker 2 So there was a tweet from Candace Owens, I think in October, a couple of years ago, where she pointed out that Kanye Wesk has been officially kicked out of GP Morgan Chase Bank.

Speaker 2 And she even showed a letter that threw him out of the bank. But again, there's context that's missing here.

Speaker 2 Like Kanye West was on television a while before that, like a couple of months before that, or a month or so before that letter was received, where he said on television, I no longer want to bank with JP Morgan.

Speaker 2 So the question is, that letter, is it the bank getting rid of Kanye or or is it the bank acknowledging that Kanye got rid of them?

Speaker 2 I'm pretty certain it's more likely to be the latter there.

Speaker 4 All right, let's continue the clip here.

Speaker 5 Under current banking regulations, under, okay, here's a great, here's a great thing.

Speaker 5 Under current banking regulations, after all the reforms of the last 20 years, there's now a category called a politically exposed person, PEP.

Speaker 5 And if you are a PEP, you are required by financial regulators to kick them off of your,

Speaker 5 to kick them out of your bank.

Speaker 2 You're not allowed to have that.

Speaker 5 What if you're politically on the left? Well, that's fine.

Speaker 4 Because they're not politically exposed so no one on the left gets debanked no i have not heard of a single instance of anyone on the left getting debanked all right so a politically exposed person they're they're a prominent figure like political figure or something like that and they're a there's a higher risk that that person will be bribed or have some sort of large influx of money into their account committing some sort of illegal activity so they essentially go on sort of the banking list this private corporation looks at their risk and says this person is very risky.

Speaker 4 They're a PEP, a politically exposed person.

Speaker 4 Now, that doesn't necessarily mean that they're debanked. It just means that they're a politically exposed person and we should pay more scrutiny to that very particular account.

Speaker 2 Yeah, exactly. I mean, the thing is, you Cecil, you're probably not a very high risk for like Russia or China or anybody to try and bribe because of the position you're in.

Speaker 2 Whereas someone like Donald Trump Jr., whose father is going to be the next president of the country, is probably quite a useful target.

Speaker 2 If you can get him owing you something, he's probably quite a useful target. So it makes sense.

Speaker 2 He is exposed politically, and therefore you want to monitor to make sure he's not getting huge amounts of money from unknown sources.

Speaker 2 With that in mind, that's almost certainly going to be true for left-wing figures who are very prominent, like Elizabeth Warren, as head of the CFPB.

Speaker 2 If you were a company who wanted to skirt those regulations and you felt you could bribe Elizabeth Warren, she'd be a great person to bribe and get on your side.

Speaker 2

So it makes sense that someone like her, she'd also be a politically exposed person. It doesn't mean she's debanked either.

And it doesn't mean that nobody on the left can be debanked.

Speaker 2

It's just saying these people could be at risk. And so we've got to watch their accounts a bit more closely.

It's as simple as that. And he's misrepresenting it.

Speaker 4

Yeah. And he's saying financial regulators.

are required requiring people to kick them out of their banks.

Speaker 4 Basically, the government is stepping into private business and saying, I'm a financial regulator, kick these people out of the bank.

Speaker 4 That's not what's happening at all if you are labeled a politically exposed person.

Speaker 2 No, although I think that kind of thing does happen when there is evidence that you are taking money from countries that are sanctioned.

Speaker 2 So I know that there were some politically exposed people who were taking money from Russia. It was going sort of via a third party on the way in.

Speaker 2 People like Dave Rubin were accepting money from what was initially a Russian source. And so that

Speaker 2 whole situation, that is something you can't have because America has currently got sanctions against Russia because of what's happening in Ukraine.

Speaker 2 So like this is why these kind of things are actually in place.

Speaker 4 All right. So I'm going to play the rest of this clip.

Speaker 5 Can you tell me what the person that you know did, what they said that got them debanked? Oh, well, I mean, David Horowitz is a right-wing, you know, he's pro-Trump.

Speaker 5

I mean, he said all kinds of things. You know, he's been very anti-Islamic terrorism.

He's been very worried about migration, all these things. And they debanked him for that.

Yeah, they debanked him.

Speaker 5 So

Speaker 5

you get kicked out of your bank account. You get kicked out of the, you can't do credit card transactions.

By the way, you can't. How is that legal? Well, exactly.

Speaker 4 Marsh, can you be debanked for having the wrong opinions?

Speaker 2 So this thing to think about for this. I can't see any way that that could be true because we could just examine the argument that they're making.

Speaker 2 They're saying that David Horowitz was debanked for being right-wing, pro-Trump, anti-Islamic terrorism, and worried about immigration.

Speaker 2 Now, if he could be debanked for that, who else would be debanked? Well, Elon Musk holds those opinions. Donald Trump holds those opinions.

Speaker 2 Charlie Kirk, Nick Fuentes, Alex Jones, we can ask, do they have bank accounts? Because if they do, obviously you have to do more to get debanked.

Speaker 2

Now, I don't know whether David Horowitz was debanked. I can't see that.

I can't see that he's really been talking about that, or perhaps I've not seen it.

Speaker 2 But what we can say is he can't actually have been debanked for his political beliefs.

Speaker 2

The idea that you can be debanked for being anti-Islamic terrorism and worried about immigration, that's going to cover a lot of people in America. It sure is.

Yeah.

Speaker 2

The idea about being debanked because you're pro-Trump. Famously, very recently, there was a very public pro-Trump statement made by a lot of Americans.

Have half of

Speaker 2 the American electorate lost their bank accounts? I don't imagine so. I think this just is not happening or is not happening in the way that they're trying to make out here.

Speaker 4

Yeah. Yeah.

You walk into a bank with a MAGA hat on and they immediately say, I'm very sorry, you can't bank here anymore. That's just not happening.

Speaker 2 Yeah.

Speaker 2 I mean, if you think about how often Trump during his electoral campaign was asking for donations from his followers, that wouldn't be worth doing if his followers had all lost their bank accounts for being his followers.

Speaker 2 It would be impossible to do.

Speaker 4

Yeah. I mean, they look at your bank statement and they see that you donated to Trump, some Trump pack.

They could easily just debank you like they suggest. And that's just not happening.

Speaker 2 Not happening.

Speaker 4 All right. This next clip here is

Speaker 4 talking about, it's really sort of trying to explain debanking, but it's doing a really sort of shifty thing by changing the parameters. So let's listen to that clip.

Speaker 5 This has been happening to all the crypto entrepreneurs in the last four years.

Speaker 5 This has been happening to a lot of the fintech entrepreneurs, anybody trying to start any kind of new banking service because they're trying to protect the big banks.

Speaker 5 And then this has been happening, by the way, also in legal fields of economic activity that they don't like.

Speaker 5 And so a lot of this started about 15 years ago with this thing called Operation Choke Point, where they decided to,

Speaker 5 as marijuana started to become legal, as prostitution started to become legal, and then guns, which there's always a fight about, under the Obama administration, they started to debank legal marijuana businesses,

Speaker 5 escort businesses,

Speaker 5 and then gun shops, just like your gun manufacturers. And just like you're done, you're out of the banking system.

Speaker 5 And so if you're running a medical marijuana dispensary in 2012, like you, guess what? You're doing your business all in cash because you literally can't get a bank account.

Speaker 5

You can't get a visa terminal. You can't process transactions.

You can't do payroll. You can't do direct deposit.

You can't get insurance. Like none of that stuff is, you've been sanctioned, right?

Speaker 5 None of that stuff is available. And then this administration extended that concept to apply it to tech founders, crypto founders, and then just generally political opponents.

Speaker 2 What I think is really interesting here, and it's worth us kind of pointing out, we've played you a couple of clips.

Speaker 2 This clip actually comes right after the previous one where he's he's talking about people being debanked for their political opinions.

Speaker 2 So we haven't cut out anything where he's saying, and I'll move on to a different subject. But what he's actually doing is he's bringing up examples of people who said are being debanked.

Speaker 2 But these aren't people who are debanked for, or businesses who are debanked for being political opponents of someone or having political opinions.

Speaker 2 These are businesses that are high risk, like crypto businesses, being debanked for business reasons.

Speaker 2 So his framing around you could lose your bank tomorrow for your opinion is just scaremongering because that is not what these are examples of at all.

Speaker 2 And he talks about, you know, issues of banking for businesses that sell weed or for escort businesses. And I looked into this.

Speaker 2 Yeah, there are legitimate issues with getting a bank account in those sectors. If that's like what you do, if that's what your business has done.

Speaker 2 But that isn't because those businesses have been deemed like immoral or amoral by the powers that be, even though they're legal. It's because they're not universally legal in America.

Speaker 2 This is the issue of a federated system, is that you have parts of America where having a weed business is perfectly legal, but other parts where it isn't.

Speaker 2 Now, that makes banking really tricky because while your marijuana dispensary might be legal in one state and not the next, the bank you sign up with works in all of those states.

Speaker 2 So you can't take money for a business that's illegal in one state and then withdraw it from another state because that is essentially money laundering or effectively along those kind of lines.

Speaker 2 So this isn't

Speaker 2 an issue, absolutely, but it's not an issue of debanking for political reasons or for ideological ideological reasons.

Speaker 2 It's mostly to do with the bureaucracy of having a state, a system rather, where some states have a law that something's legal. And in other states, that thing is still illegal.

Speaker 4 And also, marijuana is illegal at the federal level, too. So also, you know, it's not just that some states have allowed it.

Speaker 4 It's that in some states, it's illegal and it's illegal blanket across the United States still.

Speaker 4 So the United States government hasn't caught up with several of these states that have made it legal for citizens to use, to buy.

Speaker 4 And so in those places, you're right. It feels it could basically be money laundering

Speaker 4 if you happen to be a bank that crosses state lines, which many of these multinational banks do.

Speaker 4 Again, this private corporation, I think we have to keep on saying this because it seems like he's implying that the government is behind this.

Speaker 4 This private corporation is looking at their risk and they're saying, we don't want to risk that. And the same thing goes for these crypto startups.

Speaker 4 He's talking about crypto startups here, as if somehow crypto startups are less risky than other things that he's talking about. Crypto startups are incredibly risky.

Speaker 4

So they sometimes stay away from these places. And he's naming crypto startups as if these are just regular old, you know, mom and pop stores.

And that's a very different type of thing.

Speaker 2 Yeah.

Speaker 2 And I think, you know, he's identified a real issue, or at least they're talking about something that's a real issue in the sense that if you are running a perfectly illegal business selling marijuana, you're struggling to get a bank.

Speaker 2 That is a real issue for a lot of people in america who are in those businesses but the answer to that isn't to throw out all of the consumer protection finance kind of uh right legislation of america it's to lobby on that particular issue so if you do feel that marijuana businesses have a hard time getting a bank and that's unfair to them given that what they're doing is legal, you should be writing to your representatives to say this is an issue you care about and they should be reforming the way that the banking works in that sector.

Speaker 2 But it's not about, that's not really what Mark is worried about.

Speaker 2 What Mark is worried about is that the businesses he's trying to promote are the ones that are getting on the wrong side of these laws.

Speaker 2 Like immediately after this clip, he even claims that he knows 30 people personally who've been debanked. I mean, he only names one, and that's David Horowitz.

Speaker 2 And it isn't clear that he's been de-banked, and certainly not for the reasons that Mark is suggesting in this interview. But what about these other 30? Well, no one else seems to have heard of those.

Speaker 2 And if these are a real issue, where are they telling their stories of being oppressed and suffering from injustice? Why is nobody speaking out about that?

Speaker 2 And what I think is really interesting is these are fairly basic questions to ask when you're presented with this information.

Speaker 2 But Joe, throughout this, is sort of just staring in amazement and saying, whoa, and how is this legal? And that's amazing.

Speaker 2 And these aren't the kind of interactions that a credible interviewer would do.

Speaker 2 If Joe really was the kind of curious kind of person that he's often painted as, he should be pushing back and asking follow-up questions here.

Speaker 4 This one, it really is just talking about how this sort of thing happens and who's in control.

Speaker 5 There's no fingerprints. Like, there's no

Speaker 5

person who there's no stick above the strings. Yeah, exactly.

Right. It just happened.

Speaker 5 And we can trace it back because we understand exactly, you know, we, we know, we know the, we know the politicians involved and we know how the agencies work and we know how the pressure is applied and we know that these banks get phone calls and so forth.

Speaker 5 And so we can loosely, like we, we, we understand the flow of power as it happens.

Speaker 5 But when you're on the receiving end of this, your specific instance of it, like you can't trace it back and there's nothing you can do.

Speaker 4 So Marsh, if you could summarize his argument in three words, how would you do it?

Speaker 2 Yeah, it's um, trust me, bro.

Speaker 2 That is his entire evidence base here, because yeah, he says all this stuff is kind of going on, but the only thing he's pointing to is, well, all the evidence is actually very cleverly hidden, and the fact that you can't see it is even more evidence of how good they are at hiding it and how powerful they are.

Speaker 2 So, all you've got is my word to go on, which isn't ideal when we've already seen him misrepresenting other stuff pretty clearly here.

Speaker 4 This is something that a lot of people who are,

Speaker 4 and I, and I don't want to call them con men, but I definitely want to say, like, certain people who try to get one over on other people will often present a problem that they have, only they really have the solution to, right?

Speaker 4

And so, he's presenting a problem to the American people and saying, This is a problem. The solution is deregulation.

I know what the solution is. I can tell you what the solution is.

Speaker 4 But the problem is a problem that we have to trust him is happening the way he's saying.

Speaker 4 And he's saying it basically happens in back channels and you have to sort of do your own detective work and you have to trust my detective work on this.

Speaker 4 And I just don't feel like someone this invested in the cryptocurrency economic arena is someone who is going to automatically be telling me the truth.

Speaker 2 Yeah, absolutely. I mean, what becomes, what became really more and more apparent to me as I was listening is that it felt like Mark came in with an agenda here.

Speaker 2 And he was quite happy to have all the rest of the conversation about, you know, rfk and about trump assassinations and various of the conspiracy theories but when it came down to it what he wanted to talk about was why we should be demonizing these consumer financial uh consumer protection legislations and so this feels like it's part of an agenda that absolutely serves him a billionaire who owns businesses that are uh that are relatively risky in their uh in their risk profile All right, this next one is talking about the SEC.

Speaker 5 This is a fun twist. This is a fun little twist.

Speaker 5 So the SEC sort of has been trying to kill the the crypto industry under Biden. And this has been a big issue for us because we're the biggest crypto startup investor.

Speaker 5

The SEC can investigate you. They can subpoena you.

They can prosecute you. They can do all these things.

But they don't have to do any of those things to really damage you.

Speaker 5

All they have to do is they issue what's called a Wells notice. And the Wells notice is a notification that you may be charged at some point in the future.

Like

Speaker 5

you're like on notice that you might be doing something wrong and they might be coming after you at some point in the future. Oh my God.

Okay. That's terrifying.

That's the eye.

Speaker 5

The eye of Sauron is on you. Okay.

Now trying to be a company with a Wells note is doing business with anybody else. Oh my God.

Right.

Speaker 5 Try to try to work with a big company, try to get access to a bank, try to do anything. So that's when they support DEI initiatives.

Speaker 5 Well, and then the SEC under Biden became a

Speaker 5 SEC under Biden became a direct application of exactly. So DEI,

Speaker 5

they did a lot with that. And then all the ESG stuff.

And ESG is a very malleable concept, and they piled all kinds of new requirements into that.

Speaker 4 I want to just let people know if they don't know what the SEC is. the SEC is the Securities and Exchange Commission, and they control a lot of,

Speaker 4 basically, they keep an eye on the stock market and things like that to make sure that there's no shady stuff going on.

Speaker 2 Yeah, exactly. And I think what's really interesting about what Mark says here is he explicitly tells you he's like the biggest crypto startup investor.

Speaker 2 So don't you think that might be the reason why he's so against crypto regulation on the movie as well? Maybe. And I think for the average person listening, you know, I'm an average person listening.

Speaker 2 I'm not a billionaire like Mark. I'm not a millionaire like Joe.

Speaker 2 I don't think this regulation will apply to you or to me, Cecil, if we're not billionaires who happen to be one of the biggest crypto startup investors in the world.

Speaker 2 It feels like, you know, he is more likely to be the one who is against this regulations than and who's going to ever see these regulations than you or I, or I'd argue, most of Joe's listeners.

Speaker 2 It's just not a regulation that's going to affect us.

Speaker 4 Yeah.

Speaker 4 I also, though, he does veer into a very specific thing called a Wells notice.

Speaker 4 What is a Wells notice, Marsh?

Speaker 2 Yeah, so I'm not an investor, so I have to look this up. There's no shame in looking stuff up.

Speaker 2 We can go to Wikipedia, literally on Wikipedia, it says a Wells notice informs the people of the firm in question that the SEC has concluded that they should be charged with violation of the securities laws.

Speaker 2 And the Wells notice indicates that the SEC staff has determined it may bring a civil action against a person or a firm and provides the person or the firm with the opportunity to provide information as to why the enforcement action shouldn't be brought.

Speaker 2 Okay, so you've already been found by the SEC to be in violation, and this is before they prosecute you. They say, could you give us any further information essentially to mitigate your case?

Speaker 2 And if Mark doesn't trust Wikipedia, he might go to the investment site Investopedia instead.

Speaker 2 They explain a Wells notice as a notification issued by regulators to inform individuals or companies of completed investigations where infractions have been discovered.

Speaker 2

So the bottom line is you don't get one of these for nothing. This isn't used speculatively as intimidation.

You only get it once you've already been caught doing something that's against the rules.

Speaker 2

And this is before they actually bring the prosecution. They say to you, here's what went wrong.

Here's what we found that we think is in violation of the law.

Speaker 2 Can you explain this in a way that doesn't look like you've broken the law?

Speaker 2 And for him to not know that or to make it seem like he doesn't know that suggests either he needs to brush up on the basics of investment law or he needs to really think about the way he's representing things to people, especially to people who I didn't know what a Wells notice is until I looked it up.

Speaker 2 I imagine a lot of other Joe's other listeners didn't know. And if they're relying on Mark to tell them, they're not going to get a very clear picture of that.

Speaker 4

And I think that's a great point, Marsh. You know, here's a person who's a billionaire investor.

They have been invest, they literally have an investing company.

Speaker 4 They are someone who is deeply invested in crypto startups. These are people who understand the workings of these regulators very, very well.

Speaker 4 And when he says something like this and he blatantly misrepresents it, you have to wonder, are you being malicious here?

Speaker 4 It's hard to imagine that someone who is this deep into regulations and understanding how these things work is just ignorant about what a Wells notice is or heard it from someone and then is just repeating something that's false.

Speaker 4 This is a person who I think really does know what a wells notice is. And the Wells notice, I think, is also there because courts take a while to sort of figure themselves out.

Speaker 4 So sometimes they have to say to other people, there's a Wells notice against these people. So maybe don't do business with them.

Speaker 4 Maybe, you know, while the courts are trying to work these things out, we as investors or other companies might want to just steer clear of this particular company because there is something that they did wrong and we are going to get to the bottom of it.

Speaker 4

And we're going to make sure that there's something that comes of this. And it could be a court case.

It could be them having to pay a fine without going to court or whatever it is, is.

Speaker 4 But something happened with this

Speaker 4 company that isn't,

Speaker 4 it's below the board, right? It's something that we need to pay attention to. And these are companies that can take away your entire life savings with a blink of an eye.

Speaker 4 I mean, we're talking your entire 401k can disappear. This sort of thing is very common in those, in those spaces, and you can lose a lot of money really, really fast.

Speaker 4 And so it's important that we have people that are watching and putting notices on certain businesses that are that might be doing some sort of shady things.

Speaker 2 Yeah. And if you imagine, you know, just being a regular person listening to Joel, I'm a regular person.

Speaker 2 I would want there to be something in place that once the SEC has found evidence that a business is doing something dodgy, let's say they found evidence of financial fraud at a company.

Speaker 2 I'm not saying they have with Mark, but like let's hypothesize a company where they've got evidence of financial fraud. I want to know before I invest in that company that that evidence exists.

Speaker 2 And that might be before that company is ever brought to trial, like in the space between, as you say, them that fraud being found out and the trial happening, that company could go on to defraud a bunch more people.

Speaker 2

And so this is a way of saying, by the way, we have found evidence of wrongdoing by this company. So bear in mind, there could be, this is even more high risk.

I think this is totally reasonable.

Speaker 2 It's utterly reasonable. And so, again, I think these are pretty reasonable questions to bring up.

Speaker 2 These are kind of the points that an average person who's really paying attention and is genuinely curious would raise.

Speaker 2 But what's really interesting is Joe's response isn't to ask anything like that or to think about what it would be like to be an investor in those companies.

Speaker 2 His understanding here is so superficial that he just acts shocked by it and then says, oh, and is that why they start investing in DEI programs? Because they feel like

Speaker 2 they're being forced to play the good guy, forced to play along with the, you know, the agenda of the left.

Speaker 2 And I think that just shows a real lack of curiosity, but also the kind of ideological bias that makes you unable to hear where the real issues are because you're just looking for the boogeyman that you've got yourself.

Speaker 2 You're looking to find evidence of the thing you hate when actually there's something really more serious that you can actually get into that's way more interesting if you're willing to listen and not just kind of reflect back your own biases.

Speaker 4 Okay, so the last clip here is talking about the new upcoming department that Vivek Ramaswamy and Elon Musk will be supposedly creating this Doge department, Department of Government Efficiency.

Speaker 5 So, this is, and I think this is an important context where, like, when Elon and Vivek talk about reducing regulation, you know, there's two ways to think about reducing regulation.

Speaker 5 It's like, oh, my God, the water in the air are going to get dirty and the food's going to get poisoned. Right.

Speaker 5 Now, some of those regulations, I think, are very important.

Speaker 5 But the other way to think about it is examples like this, which is just raw government power being applied to ordinary people who are just trying to live their lives, are just trying to do something legitimate, and they're just on the wrong side of something that the people in power have decided.

Speaker 2 This, I think, was the most interesting sort of part of the whole conversation.

Speaker 2 This is the key to the whole block of this section of the interview, because bear in mind, Mark has just already told you that he is the biggest crypto startup investor in the world and that the regulations are making it hard for him to make a lot of money from his super risky business, his crypto business.

Speaker 2 That the money is coming from people like the listeners, people like you or I who just invest in these things.

Speaker 2 And now he's saying his billionaire friends, Elon Musk and Vivek Ramaswamy, are here coming in to take away those protections so he can carry on making lots of money.

Speaker 2

But those protections that they're taking away are there to protect the consumers. They're not there to protect anybody else.

They are there to protect the consumers.

Speaker 2

And Elon specifically retweeted this clip as evidence for how evil the government is. That's what set off that whole social media storm.

That's what set off the whole bloggersphere storm.

Speaker 2 And into the real media was Elon saying this conversation proves how evil the government is because of the way they can debank you and these regulations.

Speaker 2 But what this really is is to me, this is an exercise

Speaker 2 in creating a permission structure for removing the protections from the average person.

Speaker 2 Because Mark, obviously, as a billionaire, wants his billionaire friends to remove the regulations, but he can't do that if the people, if the average voter are completely against that.

Speaker 2 It's going to look very negative.

Speaker 2 So he has to come on the show instead and scaremonger and mislead about what these regulations actually are in order to create the permission structure for people to be against these regulations and therefore for it to be a good good thing when they're removed.

Speaker 2 That for me is what's happening here.

Speaker 4 And I think too, there's, you know, it's not just protections for the average citizen or the average investor. It's also protections for these companies, right? So like we're talking about banks.

Speaker 4

So we're talking about traditional companies. And these traditional companies have gobbled up a lot of the market.

We have a capitalist system here in the United States.

Speaker 4 They protect their market share. And I get it.

Speaker 4 And I understand too, that there may be some very high-paid capitalist lobbyists that are going to talk to the government and making rules harder for the little guy to start things up.

Speaker 4 And I don't disagree that that might be something we need to look into here.

Speaker 4 But we also should be paying attention that this person is heavily invested in these things changing because they are on the outs of that particular group. What they want is they want to change it.

Speaker 4

But what he's suggesting doesn't sound like he's saying change the rules. rules for these banks.

He's saying change the rules for you and I.

Speaker 4 Change the rules for all these little investors so that we can come in and,

Speaker 4 you know, maybe rug pull those people.

Speaker 4 So I don't, I, I, I would, I'm a little leery of his comments here because it seems like he's saying, let's make sure that we pull away these very basic protections against investors.

Speaker 2

Yeah, absolutely. And I think the point you make there about there being a load of lobbyists, I think absolutely right.

I'm against the amount of money that's in politics.

Speaker 2 I'm against the amount of money that pulls into lobbyists who then try to push politicians to do what they want. But if we're talking about very, very rich people

Speaker 2 using their finances to put pressure onto politicians to get what they want, what is Mark doing here? Yeah, right. What is Elon doing here?

Speaker 2 These are very rich people who have the ears of prominent politicians trying to get them to change regulations to be favorable to Musk and to Mark, using

Speaker 2 their financial muscle to do that. This is nothing more than lobbying, essentially, or just lobbying in a different form.

Speaker 2 And I think what's really interesting, so this whole bit of the conversation is what really, really stood out to me.

Speaker 2 So Mark introduced the concept of debanking by saying it stops ordinary people doing ordinary things.

Speaker 2 You can be attacked for your political opinions, for being a political opponent of the government. All of these examples are billionaires starting crypto banks or cryptocurrency companies.

Speaker 2 And his goal here is to take away the things that protect investors from companies with shaky or shady financial footings in order to stop those investors losing their money.

Speaker 2 That's what those kind of guardrails are for. And they can't do that without first getting this support amongst the general public.

Speaker 2 So yeah, here's Mark, a billionaire using a millionaire's shore, Jules, to demonize the things that protect you from him. Like, I think this is

Speaker 2 a fox trying to persuade you that the fences are oppressing your chickens. That's what this is.

Speaker 4

That's a great analogy. Yeah, you're absolutely right.

This is a millionaire talking to a billionaire about how the little guy needs this sort of thing taken away so that they can prosper.

Speaker 4 And that's just not true.

Speaker 4 All right. We're going to move on now to talk about what we're going to be adding to the skeptical toolbox.

Speaker 4 Wow. So that's the tool bag? And something just fell out of the toolbag?

Speaker 2 On a show like this, where we're trying to figure out what's true and what isn't as best as we can, it can't all just be about fact-checking because, you know, let's be fair to people.

Speaker 2 We can all misremember a fact in the middle of a live conversation, especially one that's three or four hours long and might involve drinking like lots of George shows do.

Speaker 2 I think fact-checking every single detail isn't the most fair way of doing this. So instead, we thought it's a good idea to look at what someone's argument tells us about what they think.

Speaker 2 And to do that, we're going to need to work with a broader set of tools than just this, just the fact-checking. So, Cecil, what's the first tool we're going to be identifying in our skeptical toolbox?

Speaker 4 So I haven't listened to a lot of Joe Rogan, but in the shows that I have listened to, the one or two shows, I will say that this is something that gets used quite a bit.

Speaker 4 And this is the straw man argument. So people do this often when they misrepresent a position, someone else's position, so they can make it easier for them to tear it down.

Speaker 4 So it's like setting up like a fake version of someone's argument so they can easily knock it over and show show how fallacious their the other person's argument is you've probably heard of this before uh someone will say something like you know the people who are against factory farming want us all to be vegan and in reality those people don't necessarily want everybody to be vegan they're they're probably going to be okay with other people eating chickens and other types of meat etc they just want to make sure that the the meat is kept the the the animals that we harvest for meat are kept in more humane conditions So when people use a straw man argument, they might sometimes misstate facts to better bolster the underlying claim.

Speaker 4 And it's a real sneaky way to distort what people actually believe to make their case look stronger.

Speaker 4 So we're going to play a few clips here of Joe and his guest distorting the conversation using this method. So here's the first clip.

Speaker 4 This is talking about a recent event that they say happened at Stanford University.

Speaker 5

You can't even have a copy of Mein Kampf in your house. Oh, a student at this is actually one of the Stanford crazy stories.

A student at Stanford was reported to the disciplinary board,

Speaker 5 the civil, whatever, disciplinary board for reading a copy of Mein Kampf

Speaker 5

in the quad. Oh my God, that's so crazy.

Which is a book that's been assigned for

Speaker 5 80 years

Speaker 5

to college kids to understand who these people were and how to not do that again. Yeah, that kid was nearly brought up on charges and nearly expelled.

So like, wow.

Speaker 5 That's that's yes, this, this is the world that I, that, that I hope that we're leaving.

Speaker 4 Good news, Mark.

Speaker 2 We are not in that world. So

Speaker 4 this is a, this is a total distortion. I looked this up afterwards because this stopped me.

Speaker 4 I'm listening to the show, and he says somebody's in the quad reading this Mein Kampf, and they immediately, they're brought up on charges and nearly expelled.

Speaker 4 And I immediately stopped and thought, wow, that's crazy. So I looked it up and it's not true.

Speaker 4 What happened was, is there was during the time that this person is in the quad at Stanford reading Mein Kampf, Kampf, it just so happened that it was during the time when there was a lot of protests against Israel.

Speaker 4

There's a lot of anti-Semitic sentiment flowing, especially on college campuses in the United States. So they looked into it and they found that it was just a person reading Mein Kampf.

That's it.

Speaker 4

It wasn't someone who was trying to antagonize people. It wasn't something like that.

It was just someone who happened to be reading it. Like they suggest a book that possibly should be read.

Speaker 4 So maybe we don't follow down that road again. And what happened was literally nothing.

Speaker 4 They immediately dropped the dropped the case they didn't do anything they looked into it said there's nothing and they moved on with their life yeah and i think the thing is like

Speaker 2 how they portray it is they nearly got disciplined which is the same as not being disciplined in that way you're saying literally nothing happened and it it might seem completely an overreaction to investigate someone for reading a book but it depends on the circumstance of the book if you're reading mein kampf in the middle of the uh the the quad at uh college it's probably fine if you're standing outside of a synagogue every day holding a copy of Mein Kampf and reading it, that might be sending a different message.

Speaker 2 So it's about context. It's worth looking into these things, but then nothing happened because there was nothing, there was no discipline to be taken because

Speaker 2

nothing had actually happened here. So like, yeah, this isn't an example of overreach or anything like that.

It's just investigate, nothing to investigate. It's fine.

Speaker 4

Yeah. And the argument that they're trying to make is that you cannot read this book.

You are not allowed to look at this book. And if you do, you will be punished.

And that isn't true.

Speaker 4 That's just not happening.

Speaker 2 Yeah, absolutely.

Speaker 4 Next up, this is talking about philanthropy and the left's war on philanthropy.

Speaker 5 Philanthropy now is a dirty word on the left because it's the private person choosing to give away the money as opposed to the government choosing a way to give the money.

Speaker 5 So I'll give you the ultimate case to here's where I radicalized on this topic.

Speaker 5 So you'll recall some years back, Mark Zuckerberg and his wife, Priscilla, you know, they have a ton of money in Facebook stock.

Speaker 5 They created a nonprofit entity called Chan Zuckerberg Initiative, which the original mission was to literally cure all disease.

Speaker 5 And this could be like, you know, $200 billion going to cure all disease, right? So like big deal. They said they committed to donate 99% of their assets to this new foundation.

Speaker 5 They got brutally attacked from the left, and the attack was they're only doing it to save money on taxes.

Speaker 2

So with this one, he did something very, very clever there or very, very interesting. He said they pledged to give away 99% of their assets.

That isn't true. That is not true at all.

Speaker 2

They pledged to give away 99% of their Facebook stock, not his assets. So not his actual wealth, just his stock in Facebook.

And he was giving that to a company that wasn't a charity, it was an LLC.

Speaker 2 And the accusation was that when that LLC then sold those Facebook stocks, he could then still profit from it, but avoid tax along the way.

Speaker 2 So the attack here wasn't, you are giving away all this money, but you should be giving it in taxes.

Speaker 2 What they're saying is you are giving away some of your stock to this company as a way of getting away from paying the taxes on that transfer of stock, but ultimately you'll still make money out of it.

Speaker 2 So here, the straw man is this wasn't an attack on him being philanthropic. This was an attack on him using tax loopholes or potentially using tax loopholes to avoid paying a fair share of tax.

Speaker 2 And that's a much harder thing to attack than to say, well, they just wanted to attack him for not giving away enough of their money to tax. That's the straw man here.

Speaker 4 And it also just is the straw man itself is very unbelievable that they're saying that suddenly the left is like, no philanthropy. Philanthropy is bad.

Speaker 4 You need to give your money to the government first and then pass it on to

Speaker 4

other people. That doesn't, I've never heard that anywhere.

Any, and I'm, I am somebody who does understand and follow left politics.

Speaker 4 In fact, I consider myself someone on the left and I've never heard anyone voice that argument at all.

Speaker 4 In fact, the only time I've ever heard it is when people are very legitimately using tax shelters to try to get some of their wealth and try to get out from underneath some of their tax burden. Yeah.

Speaker 4 This next clip is about,

Speaker 4

you know, this is, this is talking about feminism. They, they veer into feminism.

We mentioned that at the beginning of the show, and this is their portion on feminism.

Speaker 4 And they're talking about a book here, a book called Lean In.

Speaker 4 And this book very specifically talks about how women should adopt more masculine roles at work and while they're in charge of other people so that they can show other people that they can be in charge and they can work in this masculine space.

Speaker 5 This book is a statement that women have agency.

Speaker 5 This book is a statement that the things that women choose to do will lead to better results. But that's what people believe on the right.

Speaker 5 On the left, what what people believe is that women are only, always, and ever victims.

Speaker 2

Yeah. I, again, I'm someone I would describe myself on the left.

I've never met anybody who would say that women are only and always victims.

Speaker 4 That is a straw man.

Speaker 2 The position on the left would be that women are more likely to be victimized because of the way that they are, they have less power in society.

Speaker 2 And so, in various situations, they are going to be discriminated against. And therefore, we should be watching out for sources and potential implications of that discrimination.

Speaker 2 But that isn't to say that women at all points are victims. Nobody has ever said that, but it's a very easy way of dismissing your critics by saying, well, that's what they think.

Speaker 2

And obviously, that's silly. It's silly for a reason.

It's silly because it's something that nobody believes. You've just invented a straw man in order to defeat it.

Speaker 4 Also, in this segment, they seem to suggest Mark suggests because he knows this author. He suggests that they received a ton of criticism for their book and they received it all from the left.

Speaker 4 And I want to point out very specifically that there is some legitimate criticism to saying that women should adapt to a

Speaker 4 workplace that favors men.

Speaker 4 Maybe we should work on how our workplaces welcome everyone and recognize everyone instead of expecting everyone to act with these sort of masculine mannerisms in order to get ahead in the workplace.

Speaker 4 We should maybe evaluate how the workplace works. This book very specifically says the workplace is the workplace and that's how it works and you need to change how you behave.

Speaker 4 And other people were criticizing it by saying, like, maybe we should actually be trying to look at how the workplace works and change that fundamentally, do some sort of systemic change on the workplace instead of on the person.

Speaker 2 Yeah. And the thing that I find interesting about that is that Mark comes from the tech sector, which prides itself on being disruptors of the status quo.

Speaker 2 And yet the status quo here is a workplace that is designed around men.

Speaker 2 And when someone comes along to propose disrupting that and saying, maybe we should look at this and is this the most efficient way of doing it? He's suddenly defensive of the status quo.

Speaker 2 Like, aren't we in favor of being disruptive? Let's disrupt the idea that all workplaces have to be based on men's needs and how men should be.

Speaker 4 So, this next piece is talking about how Dick Cheney endorsed Kamala Harris.

Speaker 5 Who could lead the party? Well, the big Nietzschean shift was when Dick Cheney endorsed Kamala and everybody cheered.

Speaker 5 If there's not a better example than that, please tell me what it is because that one was

Speaker 5 nuts.

Speaker 4

Okay, so Dick Cheney did endorse Kamala Harris. Liz Cheney did endorse Kamala Harris.

Not everyone cheered.

Speaker 4

I am someone who, like I suggested, was on the left, and there was a lot of people on the left who said, that's a terrible idea. Get rid of their endorsements.

Don't sit with them on a stage.

Speaker 4 What are you doing?

Speaker 4 You're basically now SAIN washing all the things that they did in the past and basically legitimizing and laundering their old bad ideas for a brand new audience that's terrible and you shouldn't do it.

Speaker 4

And that was a giant movement on the left to make sure that that didn't happen. That is absolutely a straw, man.

Not everyone on the left cheered when that happened.

Speaker 2 Yeah, and it's really, really easy to find very prominent left-wing voices who are incredibly critical of that. I mean, Jon Stewart did a whole segment on it.

Speaker 2 They're daily show saying that the Cheneys endorsement isn't something that the Democrats should be embracing.

Speaker 2 There was articles in newspapers saying this is not something that we should be celebrating. So the idea that everybody cheered it is obviously nonsense.

Speaker 2 The other thing to bear in mind is you can't stop someone saying, I'm going to vote for you. What you can do is not stand on stage next to them, and you should be criticized for that.

Speaker 2 But like, Dick Cheney can come out and say,

Speaker 2

you can come out and say he's going to vote for whoever he likes, to say thank you, and you're brilliant. That's the bit that would be an issue.

And a lot of people took issue with it. Yeah.

Speaker 4 And I'm the last person that thinks I'm smart. Trust me.

Speaker 4 Marsh, we should, I think, when we listen to these, even though we're listening to them with a critical eye, we should at point acknowledge if there's anything in it that struck us as worthwhile or struck us as something that maybe we liked.

Speaker 4 So is there anything in this that you particularly liked?

Speaker 2 Yeah, I think this is a tough one, but what I would say is this is the first show and it was pretty much my first real experience of Rogan.

Speaker 2 And I've got to admit, I do understand the appeal of like the unstructured freewheelingness of it. I think it's really interesting.

Speaker 2 I think that in itself is genuinely quite interesting to sit and listen to someone for three hours and the conversation could go anywhere.

Speaker 2 I mean, it felt a bit in this one, like Mark was trying to eventually get it to somewhere he wanted it to be.

Speaker 2 But the idea that the freewheeling conversation just kind of goes anywhere it likes, that could be a really good thing. That could be a really good show.

Speaker 2 The problem is, that freewheeling just seems to constantly roll into things that aren't true.

Speaker 2 But structurally, I thought that was quite an interesting, it is genuinely interesting and was quite listenable for that reason.

Speaker 4 I think one thing I want to take away from what you said, though, is that in some ways, us looking at Joe's conversation and us

Speaker 4 like listing out the things that are said as falsehoods, the thing is, is that we presume that this is all factual, right? We presume when we listen to them that they're saying factual things.

Speaker 4

They don't have any notes in front of them. They're talking, like you suggest, freewheeling for three straight hours.

They're just having this sort of stream of consciousness conversation.

Speaker 4

We don't get a chance to see any papers in front of them. They're not really looking anything up online unless they want to laugh at it for a minute or so.

They most of the time just go off of memory.

Speaker 4 And so when we hear this, we immediately think this person is giving us information that we can trust. And very often they're just, they're just saying something in the moment in a conversation.

Speaker 4

And we as consumers of this media, we need to stop ourselves and say, this is a conversation. This is not news.

This is not a newsworthy event that's happening.

Speaker 4 And what happened was, is this immediately got clipped out and got sent out to everyone as news. And there's a ton of falsehoods in it.

Speaker 2 Yeah, yeah, absolutely. And I think the thing is, what you're saying there, that this is just, this is just off the cuff, these aren't notes.

Speaker 2 Those are the kind of defenses that I think Joe Rogan might himself bring up is to say, well, you shouldn't take this too seriously. I'm just kind of, we're

Speaker 2 shooting it from notes.

Speaker 2 But the problem is, that is not the level, the level of sway and the level of influence that this show and this platform has isn't at the level of some people talking off the top of their head who don't really know what they're on about.

Speaker 2

As we pointed out, this influenced a lot of people ahead of of the election. A lot of people genuinely listen to Joy.

He's arguably one of the world's most listened to human beings.

Speaker 2 And I think once you're at that level, if you're going to talk about things that you're making declarations of truth and fact and talk about how crazy something is, you kind of have an obligation for that to be true because of the amount of people who are going to listen to you and believe you.

Speaker 4 One of the things that I found very interesting about this, and I don't, I'm going to preface this by saying I don't understand a lot about the AI world.

Speaker 4 I'll admit that freely,

Speaker 4 but I have, have, like a lot of people, have had some trepidation with the oncoming influx of AI art, AI deep fakes that we're seeing of people and AI movies and video now that looks a lot more real than it did a year ago.

Speaker 4 And so

Speaker 4 we're in for something in the future where we're not possibly going to be able to tell the difference between something that's AI and something that isn't, that was created in the real world.

Speaker 4 And his suggestion, Mark's suggestion during this episode seemed to strike me.

Speaker 4 He said, one thing we can do to try to combat this is we can create a sort of digital stamp on official media from an official person.

Speaker 4 So like let's say a Joe Rogan show, for instance, the official media would be stamped with a very specific stamp and that stamp would then go, it would be logged in the blockchain.

Speaker 4 And then the blockchain, which is harder, supposedly harder to hack and to get into, would then have this particular stamp and no one would be able to recreate it because it wasn't logged on the blockchain as official media.

Speaker 4 So anything else you see that doesn't have that particular stamp, you could then disregard because it was taken not from the original source.

Speaker 4 And so it's a possibility of a way to try to mitigate some of the issues. But I will point out, Mark is in charge of a lot of things that deal with the blockchain.

Speaker 4 So it could just be him just saying, hey, hey, I also want to try to drum up business in this particular way too.

Speaker 2 Yeah, yeah, for sure, for sure.

Speaker 4 So that's it for the main portion of the show this week. You can check out our Patreon section for our behind the curtain gloves off segment.

Speaker 4

We're going to be doing a little more of this episode behind the curtain. So you definitely want to join in.

And we definitely don't take the same tone that we do on the main show.

Speaker 4 So next week, we're going to be covering Evan Hafer, who is the CEO and owner of the Black Rifle Coffee Company. And we're going to to be talking.

Speaker 4 He's also an ex-Navy SEAL and someone who worked with the CIA. So you're not going to want to miss it.

Speaker 4

If you love the show, please rate and share it. If you want to get in touch with us, become a patron, or check out the show notes, go to knowrogan.com.

K-N-O-W-R-O-G-A-N dot com.

Speaker 6 It's that time of year again, back to school season.

Speaker 6 And Instacart knows that the only thing harder than getting back into the swing of things is getting all the back-to-school supplies, snacks, and essentials you need.

Speaker 6 So here's your reminder to make your life a little easier this season.

Speaker 6 Shop favorites from Staples, Best Buy, and Costco all delivered through Instacart so that you can get some time back and do whatever it is that you need to get your life back on track.

Speaker 6 Instacart, we're here.

Speaker 7 Start your journey toward the perfect engagement ring with Yadev, family-owned and operated since 1983. We'll pair you with a dedicated expert for a personalized one-on-one experience.

Speaker 7 You'll explore our curated selection of diamonds and gemstones while learning key characteristics to help you make a confident, informed decision.

Speaker 7 Choose from our signature styles or opt for a fully custom design crafted around you.

Speaker 7 Visit yadavjewelry.com and book your appointment today at our new Union Square showroom and mention Podcast for an exclusive discount.