BONUS EPISODE | The Death of the Dollar | The Clay Travis and Buck Sexton Show

Clay Travis and Buck Sexton tackle the biggest stories in news, politics and current events with intelligence and humor. From the border crisis to the madness of cancel culture and far-left missteps, Clay and Buck guide listeners through the latest headlines and hot topics with fun and entertaining conversations and opinions. In this segment, Clay and Buck discuss the death of the dollar in America.

Want more? You can find The Clay Travis and Buck Sexton show anywhere you listen to podcasts.

https://podfollow.com/1498106610

Learn more about your ad choices. Visit megaphone.fm/adchoices

Press play and read along

Transcript

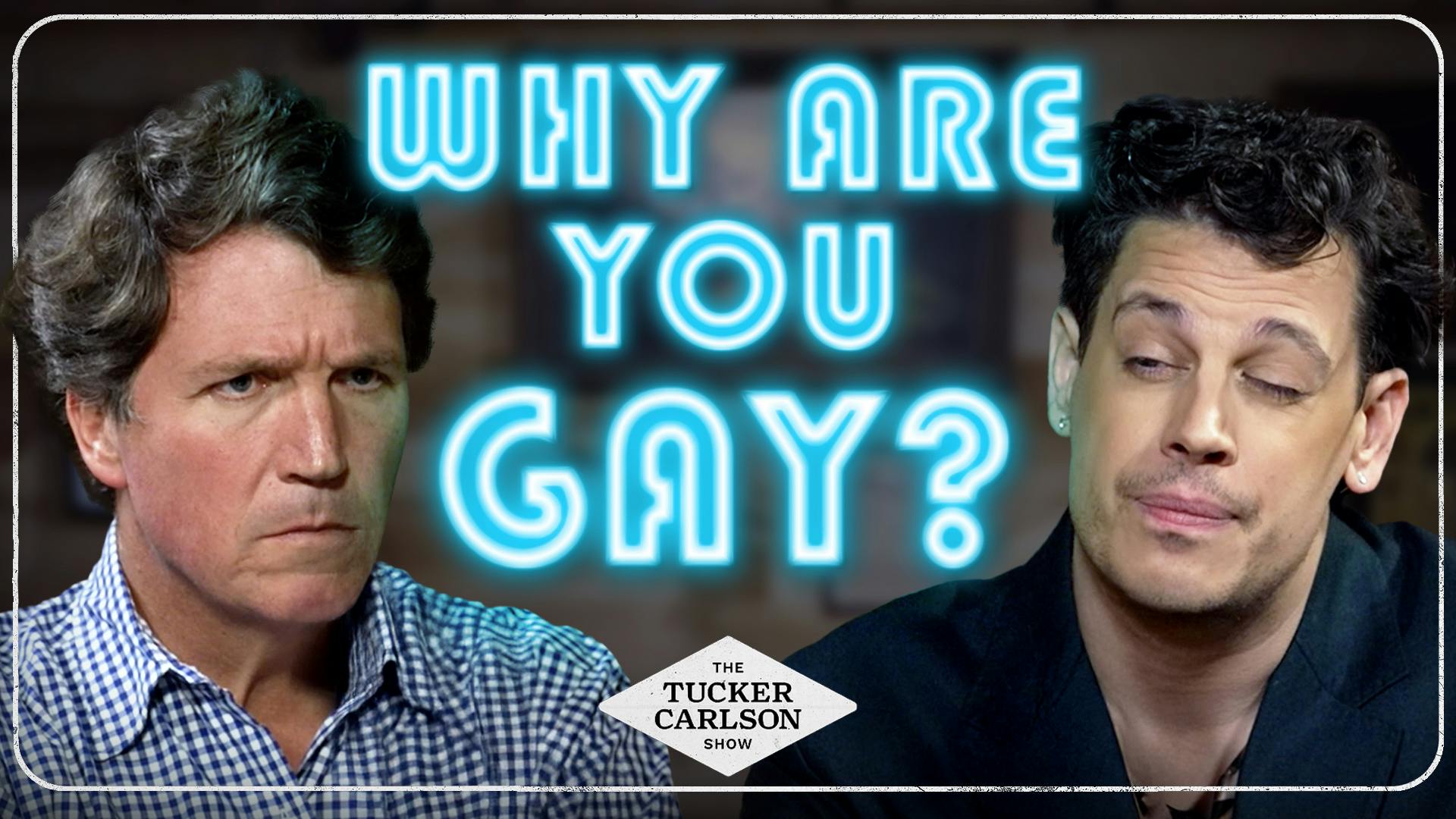

Speaker 1 Hey, what's up, Tucker listeners? Clay Travis here from the Clay Travis Buck Sexton Show. Like you were huge fans of Tucker Carlson, known him a long time, both personally and professionally.

Speaker 1 We always talk about how to get more people on Team Sanity, the untapped masses, who favor common sense over craziness.

Speaker 2

Hey, this is Buck. Clay and our friend Tucker are exactly right.

We want to rally the forces for good, making sense in an insane world.

Speaker 2 If that sounds like something you want too, we encourage you to subscribe to our podcast.

Speaker 1 It's all about strength and numbers. Tucker's a truth warrior, someone we want in our foxhole, but we want you in our foxhole too.

Speaker 2 The more of us, the less of them. But how do you get them to see the light? You listen to Tucker, you listen to us.

Speaker 1 Pretty easy, but also fun because we get into it every day for three hours. Critical thinking never sounded so good.

Speaker 1 Subscribe to the Clay and Buck podcast on the free iHeartRadio app or wherever you get your podcast.

Speaker 2 And if you haven't checked us out yet, here's a sample of what you'll hear.

Speaker 3 Welcome to today's edition of the Clay Travis and Buck Suxton Show podcast.

Speaker 4 Buck, I wanted to talk about this because we mentioned it yesterday.

Speaker 4 The Senate has passed a $95.3 billion payment,

Speaker 4

your tax dollars, going to fund the border and protect the border of Ukraine, Taiwan, and Israel. 22, I believe, is the number Republican senators supported this bill.

It's now moving on to the House.

Speaker 4 Yesterday I was reading, and I just want to ask you, I want all of you to think about this as a broad idea.

Speaker 4 We are now $35 trillion roughly in debt. When the Tea Party started

Speaker 4 and became an issue, we were at $10 trillion in debt. So we're averaging, adding about a trillion dollars a year to our national debt.

Speaker 4 I saw a report from the Congressional Budget Office. I was reading about it yesterday, Buck, that we are on pace to have a $54 trillion federal deficit a decade from now.

Speaker 4 And

Speaker 4

my son is 16 years old. He's a sophomore in high school.

And he's just starting to study economics.

Speaker 4 And we were having this conversation recently. The dollar is the default currency for the world.

Speaker 4 What happens if suddenly our foreign adversaries who own trillions of dollars in American debt,

Speaker 4 what happens, Buck,

Speaker 4 if one day they just decide they're not going to buy the debt that we are constantly issuing out there?

Speaker 3 What you're talking about is the death of the dollar as the global reserve currency and the end of American dominance in all respects, including our quality of life that we have gotten very used to in this country,

Speaker 3 where we can be these massive consumers and get deeply indebted, and it doesn't really affect things for us.

Speaker 3 I mean, part of the problem is, yes, we complain the economy is not as good now as it should be,

Speaker 3 but

Speaker 3 you've spent some time in countries, I'm sure, sure, where you see what real economic deformation looks like or real economic reversal looks like. And

Speaker 3

it is a shocking thing. It is a devastating thing to that nation.

And I think that, unfortunately, right now,

Speaker 3 we don't have a system that will allow this to turn around.

Speaker 3 We don't have people who are willing to make decisions today that take the future into account. This is a function of math.

Speaker 3 Isn't it interesting there are so many people who are much more concerned about climate, it seems, than about the debt these days.

Speaker 3

One of them is a real thing that is not a real problem, meaning climate is changing. It is always changing.

Yes, of course it changes. It bears no real threat to humanity and to us whatsoever.

Speaker 3 And the other thing is a mathematical certainty that the debt burden will become so heavy that it will crowd out other spending.

Speaker 3 and it will change the lives of the American people in future generations in ways that we would really hate to see.

Speaker 3 And that can, of course, lead to social unrest, civil unrest, all kinds of other problems as well.

Speaker 3 But I can sit here and talk about it, and we can talk about where the debt was in the Tea Party era in 2010 versus where it is now. I think it was, what was it, $10 trillion?

Speaker 4 Yeah. We've added $25 trillion in debt since the Tea Party.

Speaker 3 So, you know, we talk about this.

Speaker 3 Look, you know,

Speaker 3 one way that Trump hit Ron DeSantis right away and it was effective was Ron wanted to cut entitlements. Even among Republicans, this is some real talk.

Speaker 3 Even among Republicans, you want to win, say you won't touch entitlement spending. You say you won't touch the retirement age.

Speaker 3 As long as that continues, we're just going to keep, I mean, that's for me, I don't want to be overly fatalistic about it, but maybe that's what I'm being. Until people feel pain, they won't change.

Speaker 3 And the problem with this is once you start to feel the pain, then the change is

Speaker 3

too late. It's all too late.

And this is where we are. You know, think about that.

I mean, Trump has said, I won't touch your Social Security. I won't touch your Medicare.

I won't touch

Speaker 3

entitlement spending. I won't touch a retirement age.

And that's a Republican from outside the establishment.

Speaker 3 And anyone who would run against him in this primary or anyone who going forward is running as a Republican, they know they'll lose if they say they want to touch any of those things.

Speaker 3 And you bring that up now. People always say, Clay, I've paid into this my whole life.

Speaker 3

Social Security is fixable and that's doable. You just make some change.

You do a little bit of means testing for rich people and you raise the retirement age a couple of years.

Speaker 3

You figure out when you do that. You get out the actuarial table.

It's not the end of the world. Medicare is a big problem because people say, oh, I've been paying into it.

Speaker 3 The average person, the average person takes out twice in Medicare spending what they pay into over the course of their lifetime.

Speaker 3 And a vast majority of that spending comes in the last six months of life.

Speaker 4 Yeah.

Speaker 3

So we have to fix these things somehow, but no one, you know, you say you want to fix it, you're a bad person. You say you want to change it.

You know, you and I are getting older.

Speaker 3 You know, at some point, we're going to want Medicare, too. I want it to be there, and I want it to be a functioning program for people.

Speaker 3 But I don't know, man. We sit here, we talk about it, look at this foreign spending we're doing.

Speaker 4 Why are we giving any of these countries? That's why it ties in.

Speaker 3 That's why it ties in. Why are we giving any of these countries? And notice,

Speaker 3 is there anyone who has been more vocally in support of Israel? Well, period, but also since October 7th than we have been on this show?

Speaker 4 I don't think.

Speaker 3

Even yesterday, I tell there's a little. What do you mean you're talking? Israel is a wealthy country.

Why are we giving Israel $16 billion? Why do we give it $3 billion every year?

Speaker 3 And it's not just Israel. Why are we giving $60 billion to Ukraine? Why do we have the foreign aid budget that we have in total? What are we actually getting for this?

Speaker 4 I agree completely. And I think it, look,

Speaker 4 if you want to give to charity, because let's be honest, that's basically what we're doing here. Then most of you, if you ran your household, you wouldn't wouldn't go in debt to donate to charity.

Speaker 4 In fact, your husband or wife, if you sat down at the table and you said, hey, for part of our budget this year, I want to give $5,000 in charity on the credit card.

Speaker 4 Every single one of you out there would look at your spouse like they were absolutely insane.

Speaker 4

If you wouldn't do in your household what the United States government is doing for our entire household. And, Buck, I don't see this as Democrat.

I don't see this as Republican.

Speaker 4 I don't see this as Independent. To me, anyone voting to give $100 billion,

Speaker 4 rounding up from $95 or $96 billion, to foreign countries when we are $35 trillion in debt.

Speaker 4 I think your analogy with global warming is a really good one.

Speaker 4 One of the biggest issues in life, this is me giving you a little bit of a TED talk, is most people fear things which in reality are not threats to them.

Speaker 4 And you spend a lot of time being fearful of things that are never going to be an issue in your life. You and I are in our 40s.

Speaker 4

I've got three kids, 16, 13, and 9. I'm building a beach house.

I've said before, I ain't worried about the rising oceans. All right.

Maybe it's going to be an issue for my beach house.

Speaker 4

If so, I was wrong. I'll deal with it.

I am insanely worried about the fact that at some point in my kids' lives,

Speaker 4 maybe even some point in my life, we're going to be $100 trillion in debt. And if you don't think that our adversaries out there are not planning on bankrupting this country,

Speaker 4 Everybody wants to talk about, oh, there's a new threat from Russia. Oh, there's a new threat from China today.

Speaker 4 The big looming asteroid that is aimed right for America, that is in danger of obliterating this country, is

Speaker 4 we're going to have $55 trillion in debt a decade from now. And then just the interest

Speaker 4 on our national debt is going to become soon the biggest single expenditure that this country has.

Speaker 3 Well, there's a long

Speaker 3

time ago. There's a long history.

There's a long history of this, of fiat currency.

Speaker 3 You can go back and even look at the usage of paper currency in

Speaker 3 China over a thousand years ago. I mean,

Speaker 3 once they start printing it in paper and once the money has no intrinsic value, it's not backed by anything, what happens? Inflation happens.

Speaker 3 And inflation, we all know what that does, particularly to those who don't hold assets. And then

Speaker 3 this is the problem we're in right now. The political mechanism to check it, even in

Speaker 3 a republic like ours, right? Even in a system where the people who are suffering from the inflation, who are suffering from these decisions, are the ones who are supposed to be able to make it right.

Speaker 3 No one can win and get the power they need to solve the problem because the person who says, keep eating those treats, they won't make you fat. Keep eating a whole chocolate cake every night.

Speaker 3

There's no problem with it. That person wins because they're appealing to the immediate and they're appealing to the sense that I get mine.

I'm not worried about what comes down the line.

Speaker 3

That is what it is bipartisan in this country. It is the truth.

And you're not even really hearing anything.

Speaker 3 We're hopefully going to elect a president who's obviously far better than Joe Biden. Donald Trump's not going to touch the debt.

Speaker 3 Anyone take bets on that one? Not going to touch the debt. He's going to spend a lot.

Speaker 3

Donald Trump spent $6 trillion last year in office, everybody. I know it was COVID.

I know, oh,

Speaker 3

we can't blame Trump for anything. Look, I love the guy.

I'm hoping he's going to be president. But if we're talking about the debt, you know,

Speaker 3 this is the situation, folks. I don't know.

Speaker 3 Man,

Speaker 3 we are a bummer on Valentine's.

Speaker 4 I think it ties in so much with

Speaker 4 the failure that we have from our elected officials.

Speaker 4 We are $35 trillion in debt, and they are telling us it's anti-American if we won't take out $100 billion in additional debt and send it to foreign countries to protect their own border while our border is wide open.

Speaker 4

And this, to a large extent, in the Senate is bipartisan. And I just look at it and I say, no one would run their family finances like the United States government does.

And just think about it.

Speaker 4 Donating to charity is a fabulous thing to do.

Speaker 4 If you were donating $5,000 to charity on your credit card that you didn't have and you were going to have to pay interest on that donation,

Speaker 4 none of you would do it. And if you had a spouse that suggested it, you would tell them that they're crazy.

Speaker 3 Well, but you certainly wouldn't say un-American.

Speaker 3 Your analogy is actually

Speaker 3 people

Speaker 3 are saying, hey, let's do something really nice for some other family. Let's do something really nice for some other family because it's going on someone else's credit card.

Speaker 3

And that's what people don't realize. It's actually our credit card.

It's the credit, the faith and credit of the American people. And we're all in it together on the dollar.

Speaker 3 It's not even a partisan thing. I don't want the dollar to collapse for any of us because then it collapses for all of us.

Speaker 4 And also to then argue that if I'm opposed to that, I'm not an American.

Speaker 4 That it's un-American to be opposed to spending $100 billion

Speaker 4

on somebody else's border. If we had a budget surplus, that's a conversation we could have.

We don't have a budget surplus. In fact, I'm concerned that all of this is going to blow up one day.

Speaker 4

We're going to try to sell debt, and there ain't going to be a buyer. And what happens then, look out.

I mean, look out in a big way.