915 - Hero Hedge feat. Joe Weisenthal (3/10/25)

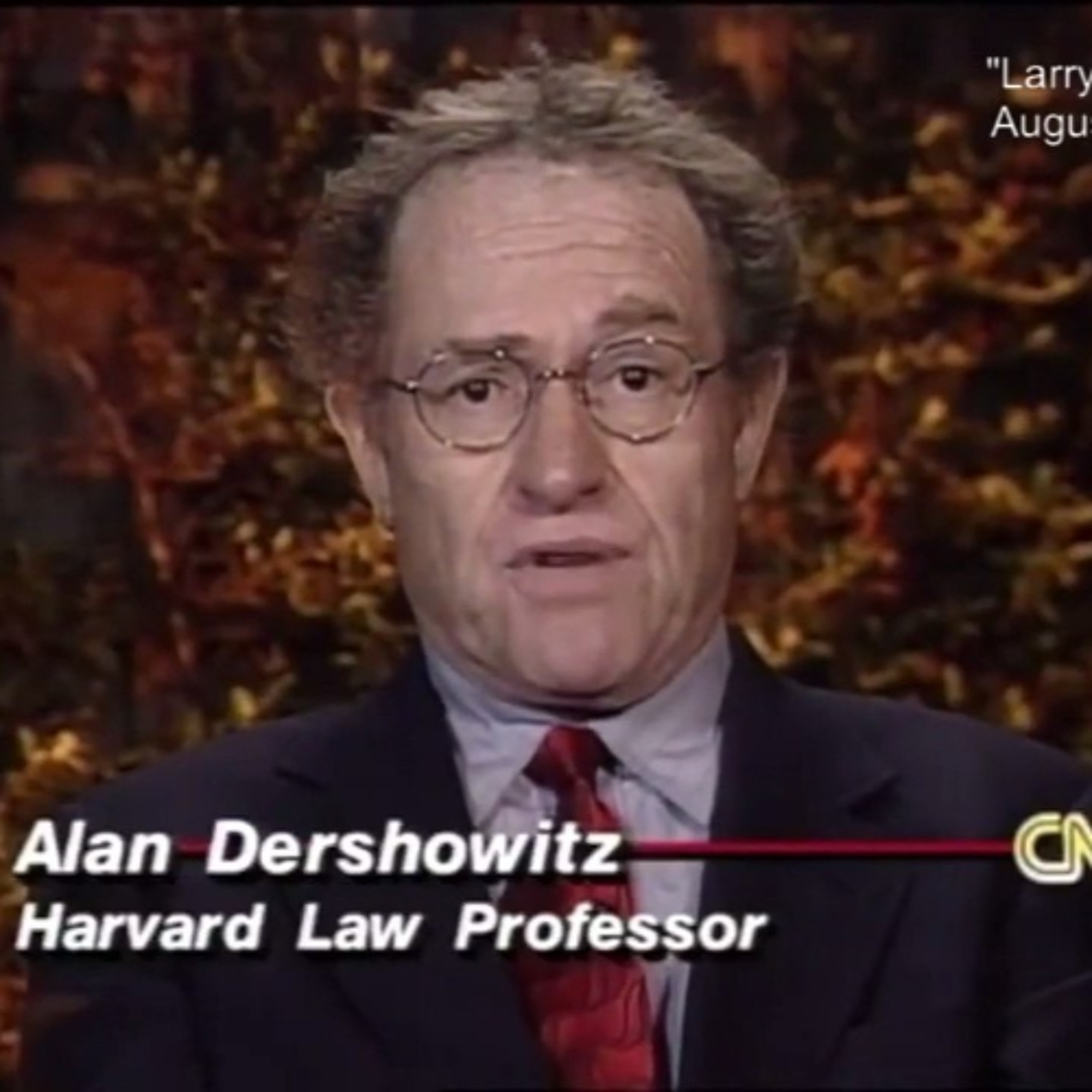

We start the show discussing the arrest and detention of Mahmoud Khalil in a glaring escalation of attacks on American civil liberties in behalf of Israel & its supporters. We’re then joined by journalist and co-host of the Odd Lots podcast Joe Weisenthal to take a shockingly timely (for us) look at markets, tariffs, crypto, and economic policy under the 2nd Trump administration. Is there a plan here? Who’s actually in charge? Will these tariffs ever actually happen? Are we careening toward a recession? Joe shares his thoughts on these questions and more with us.

Listen to Odd Lots wherever you get podcasts, and find Joe’s work at Bloomberg here: https://www.bloomberg.com/authors/AQ0VXvE12t0/joe-weisenthal

Go see Eephus as it rolls out to your neck of the woods, search for showtimes @ https://www.eephusfilm.com/

Listen to Odd Lots wherever you get podcasts, and find Joe’s work at Bloomberg here: https://www.bloomberg.com/authors/AQ0VXvE12t0/joe-weisenthal

Go see Eephus as it rolls out to your neck of the woods, search for showtimes @ https://www.eephusfilm.com/

Press play and read along

Transcript

Transcript is processing—check back soon.

Chapo Trap House — 915 - Hero Hedge feat. Joe Weisenthal (3/10/25)