The deal with "back door" betting

Wanna put a wager on, well, just about anything? Try a prediction market. Competing industry giants Kalshi and Polymarket both saw major investment this week, and for good reason. Though they don’t look it on paper, both function as (extremely lucrative) sports betting platforms but don't face the regulations of sports betting platforms. In this episode, we bet on where that legal loophole is headed. Plus: Expect car sales to sputter as the EV tax credit ends and tariffs drive up costs, and the case for replacing subsidized air travel with a more robust rural bus system.

Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.

Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

Press play and read along

Transcript

Speaker 1 Introducing your new Dell PC with the Intel Core Ultra Processor. It helps you handle a lot even when your holiday to-do list gets to be a lot.

Speaker 1 Like organizing your holiday shopping and searching for great holiday deals and customer questions and customers requesting custom things, plus planning the perfect holiday dinner for vegans, vegetarians, pescatarians, and Uncle Mike's carnivore diet.

Speaker 1 Luckily, you can get a PC with all-day battery life to help you get it all done. That's the power of a Dell PC with Intel inside, backed by Dell's Price Match Guarantee.

Speaker 1

Get yours today at dell.com/slash holiday. Terms and conditions apply.

See Dell.com for details.

Speaker 2 When your company works with PNC's corporate banking, you'll gain a smart and steady foundation to help you carry out all your bold ideas.

Speaker 2 But while your business might not be shaky, you might still experience shakiness in other ways.

Speaker 2 You might be outbid on the perfect summer house, your kid might not attend your alma mater, or your yacht might be jostled by stormy waters.

Speaker 3 No amount of responsible banking can prevent these things, except maybe the yacht, because we tell you boats are generally a bad investment.

Speaker 2 PNC Bank, brilliantly boring since 1865. The PNC Financial Services Group Inc., all rights reserved.

Speaker 1 I mean, what do you like? The trade war ramping up again? The White House disassembling the federal workforce under cover of shutdown? The shutdown itself, by the way?

Speaker 1

Happy Friday, everybody. From American Public Media.

This is Marketplace.

Speaker 1

In Los Angeles, I'm Kai Rizzo. It is, as I said, Friday.

This one is the 10th of October. Good as always to have you along, everybody.

Speaker 1

I am not going to waste any time setting things up because we have lots and lots to talk about. Catherine Rampel is at MSNBC, also the new economics editor at the Bulwark.

Courtney Brown's at Axios.

Speaker 1 Hey, you two.

Speaker 4 Hey, Kai.

Speaker 1 Hey, Kai. Catherine Rampel, I begin with you, and just by way of setup, since I did sort of get us into this conversation, lickety split.

Speaker 1 Yesterday, the Chinese government comes out and says, you know what, we're going to pull back and exert more control over our exports of rare earth metals.

Speaker 1 Today, the President of the United States takes great offense at that and says, not only am I not going to meet Xi Jinping at our next scheduled meeting at the Apex Summit, but also I'm going to impose, and this is a quote I'm thinking about, massive tariffs.

Speaker 1 The stock market reacted as one would expect. I would like you to discuss, please.

Speaker 4 I will say I have been on maternity leave the last three months, and I feel like nothing has changed.

Speaker 4 I feel like this is the exact same news cycle we had three months ago and six months ago and at the very beginning of this year.

Speaker 4

Yeah, we just are stuck in this endless loop of more and more tariffs. Markets react.

Then the White House sometimes gets a little bit freaked out by that and rolls things back or pauses or whatever.

Speaker 4 And maybe that's back where we are, where that's maybe that's where we'll be again. I don't know.

Speaker 4 But either way, the uncertainty that all of this causes, even if the tariffs don't materialize, cannot be good for the economy.

Speaker 1 Courtney Brown, Russell Vogt, the head of the OMB and the president's right-hand man in disassembling the federal government now that Elon Musk is gone, said today that those layoffs during the shutdown that were promised by him

Speaker 1 have begun.

Speaker 1 Number one, talk to me about what you think that means, and then I've got a follow-up. So go ahead.

Speaker 5 We have some reporting that indicates that some agencies, including Treasury and HHS, have

Speaker 5 started to do the RIF reduction in force process.

Speaker 5 And so this changes the calculus a little bit. I think economists at Goldman Sachs and other big shops have said, yeah, there's usually an economic impact from government shutdowns.

Speaker 5

It's usually small. It's usually fleeting.

There's usually a payback aspect when the government reopens.

Speaker 5 But what happens if measures are taken during this shutdown that don't get reversed, like permanent layoffs? I think there does end up being some economic effect, however

Speaker 5 big, small, whatever,

Speaker 5

that impacts people. And I think we think about the economy as this large thing, but the big U.S.

economy is made up of a bunch of smaller economies.

Speaker 5 And if you are in an area like where I live in Washington, D.C., in the DMV area, these federal layoffs may not show up in economic statistics, but it affects the local economy.

Speaker 5 So you can't really just shrug it off the way that maybe some would like.

Speaker 1 All right, here's the follow-up. And Catherine, you're going to get the same question in about a minute.

Speaker 1 But the Trump administration, his cabinet officials, the president himself, every time the economy comes up, it is, this is Joe Biden's economy. Joe Biden did this.

Speaker 1 It's Biden's fault every single time. Here's my question.

Speaker 1 Really? Come on, man.

Speaker 1 Courtney?

Speaker 5 This is the Trump economy. This is the

Speaker 5 trade environment that the Trump administration wanted. This is the

Speaker 5 smaller government that the Trump administration wanted. All of the policies that

Speaker 5

the Fed is worried about with respect to inflation, they are a direct result of Trump policies. So they have to own it.

This is the Trump economy.

Speaker 1 Catherine, same question, but with a twist. What then do you think 2026 looks like? Because 2025 is, I mean, we're close to done.

Speaker 4 Oof.

Speaker 4 So, Kai, I think you and I have probably been similar in that most of our lives, most of our careers anyway, we have been saying, or at least I've been saying, the president always gets too much credit when the economy is good, too much blame when the economy is bad.

Speaker 4 Presidents do not control the economy, which is generally true. And so, like, normally I would bristle at the very premise of the question, is this the Trump economy or the Biden economy?

Speaker 4 Because there's not a lot presidents can do to like make the economy better, at least in the short run. Turns out there's a lot that they can do to make it worse.

Speaker 4 And there's, you know, Trump could get out of his own way, and we could have a much better economy with his brand or not if he just stopped with the tariffs and deporting much of the workforce and various other things that I think have been unhelpful.

Speaker 4 To get to your second question about 2026,

Speaker 4 God, I don't know.

Speaker 4 Nobody knows. I don't think Trump even knows to the extent that, again, his policies are shaping the economic trajectory.

Speaker 4

If he got out of his own way and stopped these needless trade wars, among other things. You know, it could be pretty solid.

The fundamentals are looking pretty good.

Speaker 4 Or had been.

Speaker 1 I'm going to take the under on him getting out of his own way, right? Quickly, Catherine, right?

Speaker 1 Yeah, it seems unlikely.

Speaker 4 I think part of the problem is the people advising him are not necessarily advising him well.

Speaker 1

Yeah. Courtney, last question goes to you.

It's on a data point from the New York Fed this week, came out with its consumer survey. We, consumers, expect inflation to be 3.4% over the next year.

Speaker 1 That's higher.

Speaker 1 That's not good either.

Speaker 5 No, not good.

Speaker 5 And

Speaker 5 it comes in tomorrow.

Speaker 1 You can stop there if you like. No, not good.

Speaker 5 I know.

Speaker 5 I'm so fun at parties. No, it comes on top of the fact that inflation is still above the 2% target that the Fed likes to see it at.

Speaker 5 And we've heard Fed officials come out and say that they're less concerned about tariff-related price increases kind of spiraling into more persistent inflation.

Speaker 5 But then something like today happens, right? We have these kind of nonstop threats of higher and higher tariffs and how that ultimately affects the inflation backdrop.

Speaker 5 I think that's going to complicate

Speaker 5 any plans that Fed officials have to lower interest rates in the months in the months ahead.

Speaker 1 Austin Goolsby said to me two weeks ago on this program, yeah, I think the inflation thing from tariffs is going to be transitory. And I was like, Austin, do you really want to use that word, man?

Speaker 1 What are you doing?

Speaker 1

Catherine Rempel is at MSNBC and the Bulwark. Courtney Brown is at Axios.

Thanks, you two. Have a nice weekend.

Thanks. You too.

Speaker 1 On Wall Street today, do I really need to tell you how traders react to all of the above? We will have the details when we do the numbers.

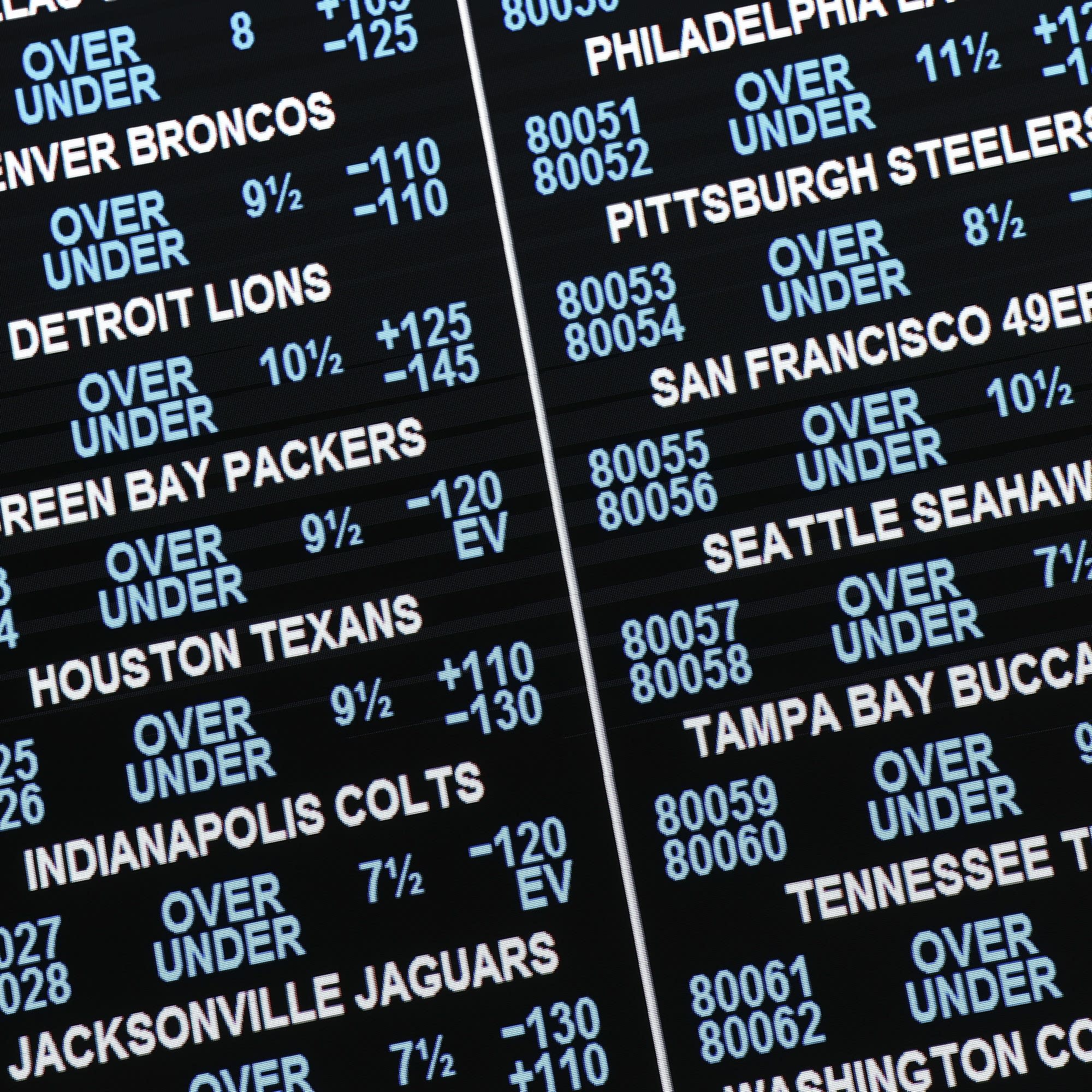

Speaker 1 Forget what the Inside the Washington Beltway pundit class says. The prediction market Calci says the chance of the government shutdown lasting more than 30 days is now almost 50%, 5-0%.

Speaker 1 For those unfamiliar, prediction markets, they're platforms actually, they're where users put actual money on the outcome of almost any question you can think of.

Speaker 1 They got a lot of attention during the presidential election last year for correctly correctly predicting the winter when traditional polls were hazier, shall we say.

Speaker 1 Two of the biggest of them have gotten some love this week.

Speaker 1 Kelchie got a $300 million funding round, $2 billion from Polymarket, from the parent company of the New York Stock Exchange, Intercontinental Exchange is the name of that company.

Speaker 1 As you might imagine, a lot of the growth that those platforms have had is being driven by sports. Marketplace Megan McCarty-Carino has more on that one.

Speaker 6 Since a Supreme Court decision in 2018 cleared the way for states to allow sports betting, the market has exploded, says Victor Matheson, an economist at College of the Holy Cross.

Speaker 6 Last year, Americans laid down about $150 billion on games.

Speaker 7 Any way for a company to get into that market, especially if they can get in through the back door, that's a big potential market for them.

Speaker 6 Matheson calls it the back door because prediction markets aren't regulated like sports betting platforms. What they're offering is considered a contract between two parties.

Speaker 6 There's no house in the gambling sense. That means they can operate everywhere, even big states where sports betting is illegal, like Texas and California.

Speaker 7 Call it not betting, but for a typical sports better, it's largely indistinguishable.

Speaker 6 Until recently, traditional betting platforms had the edge on parlays, where you wager on multiple outcomes at once, like the Dodgers will win the World Series and score at least five runs in the final game.

Speaker 6 But Calci has been catching up with new user-friendly tools to make parlay bets easy, says analyst Brant Montour at Barclays.

Speaker 7 So they basically built a front end for the user experience that mimics the front end of a traditional online sports book.

Speaker 7 You know what they say if it looks like a duck, talks like a duck, walks like a duck, it's a duck.

Speaker 6 Daniel Wallach is an attorney specializing in sports gaming.

Speaker 6 He says there's there's a growing list of lawsuits challenging the legality of sports contracts on prediction markets, and the issue is likely to go to the Supreme Court.

Speaker 6 I'm Megan McCarty-Carino for Marketplace.

Speaker 1 Should you find yourself having to get from Pendleton, Oregon to Portland, you could make the three-hour drive or you could jump on an eight-seater plane for the 55-minute flight.

Speaker 1 You've got that option thanks to the Essential Air Service Program, which is a federal subsidy created after airline deregulation back in the 1970s to keep small and rural communities like Pendleton, Oregon connected.

Speaker 1

In its budget proposal for this fiscal year, the Trump administration wanted to cut the $500 million a year cost by almost two-thirds. Congress still hasn't decided what to do.

See also the shutdown.

Speaker 1 But some transportation experts wonder if we ought to spend some of those federal dollars on buses instead. From Oregon Public Broadcasting, Lillian Kerbic has more.

Speaker 8 A few weeks ago, I met Ken Buck Buckley at a bus station in eastern Oregon, stranded with a broken truck and a whole bunch of antlers.

Speaker 9 2,400 pounds. I buy and sell deer and owk antlers in North Dakota and eastern Montana and western Minnesota.

Speaker 8 Buck called a AAA driver to tow his truck.

Speaker 9 He said, give me an additional $500 and I'll get your antlers to market. Instead of leaving them on the side of the road, I said, done deal.

Speaker 8

After selling the antlers, he still needed a new truck. He found one in Portland and figured he'd take the bus to pick it up.

five hours away.

Speaker 8 But when he reached this bus station, there was no Greyhound from Pendleton to Portland anymore. His best option was to take a local bus 90 miles into the next city, then hop on a 55-minute flight.

Speaker 11 Boutique Air flies three round-trip flights from Pendleton to Portland every day.

Speaker 8 That's Eastern Oregon Regional Airport Manager Dan Bandle.

Speaker 11 It's the only essential air service activity in the Pacific Northwest.

Speaker 8 Federal funding for the air service ensures people in remote communities can get to family engagements and medical appointments. That's important as rural health care facilities shutter.

Speaker 8 A one-way ticket runs only $59,

Speaker 8 but only because the federal government covers almost 80% of the cost.

Speaker 11 If it was $250 a person, then it wouldn't be cost-effective. But, you know, less than half of that for a family of four to fly.

Speaker 8 The plane is so tiny that passengers are weighed before boarding. But as you might hear on the local radio ads, flying is a laid-back experience.

Speaker 11

Flying from Pendleton, there's no TSA, so you leave your boots and belts on. For now, Flying Boutique is affordable, fun, and convenient.

Boutique Air.

Speaker 8 Now, if you tried the same trip by bus, not fun, not convenient. It would be four transfers, nine and a half hours, and still cost about the same.

Speaker 8 Joe Schwederman, a professor of transportation at DePaul University, thinks subsidizing the rural inner city bus system could help it compete with air.

Speaker 12

It really is a mismatch. And sadly, we're seeing now places that have Essential Air Service that have no bus service.

And that's really a dysfunctional situation.

Speaker 8 With all this talk about if Essential Air Service deserves more federal funding, Schwederman points out that bus subsidies could reach more people for less money.

Speaker 12 We feel that a bus is just a bargain. Just a fraction of what, of course, an air service would cost.

Speaker 8 Without more federal investment, Schwiederman says buses are going to disappear from rural communities. But it doesn't have to be that way.

Speaker 12 Boosting subsidies by two or three fold is still a small amount, but you probably could get a national route system that's covered.

Speaker 8 Right now, though, federal funding for all rural transportation is under debate. And that means soon, rural residents might find themselves without an option for a bus or a plane.

Speaker 8 In Pendleton, Oregon, I'm Lillian Carr Bake for Marketplace.

Speaker 1 Coming up.

Speaker 13 Where I live right now looks almost like a small house.

Speaker 1 Almost is doing a lot of work there. But first, let's do the numbers.

Speaker 1

Ah, the Wawas, we hardly knew you. The Dow Industrial is down 878 points today, 1.9%, 46,479 for the blue chips.

The NASDAQ down 820, that's 3.6%, 22,204.

Speaker 1 SP 500 gave back 182 points, 2.7%, 65, and 52. For the five days gone by,

Speaker 1 the Dow off 2.4%.

Speaker 1 The NASDAQ dipped 2.5%. SP 500 slipped to 1.4 tenths of 1%.

Speaker 1 Megan McCarty Carino was talking about prediction market platforms like Polymarket, parent company of the NYIC, which I mentioned, Intercontinental Exchange, Intercontinental Exchange.

Speaker 1

Guys, slow down. His investing in Polymarket slumped 1.1%.

Today, retailers that depend on Chinese imports lost big gap down 3.5%. Best Buy SAC, 6.4%.

Speaker 1 Bonds up. The yield on the 10-year T-note fell to 4.06%.

Speaker 1

Can you say, Safehaven? Sure. I knew you could.

You're You're listening to Marketplace.

Speaker 1 This Marketplace podcast is sponsored by the University of Illinois Geese College of Business. For many, the next step in their career is an MBA, but finding the time and budget can be a challenge.

Speaker 1 The University of Illinois Geese College of Business offers their online MBA, the IMBA. It's fully online, flexible, and delivered at a fraction of the cost of a traditional MBA.

Speaker 1 Students get the same world-class Illinois faculty and an interactive global network all designed to fit their lives. To learn more about the Geese IMBA, visit online MBA.illinois.edu.

Speaker 1 That's online MBA.illinois.edu.

Speaker 15 Fifth Third Bank's commercial payments are fast and efficient, but they're not just fast and efficient. They're also powered by the latest in payments technology built to evolve with your business.

Speaker 15 Fifth Third Bank has the big bank muscle to handle payments for businesses of any size, but they also have the FinTech hustle that got them named one of America's most innovative companies by Fortune magazine.

Speaker 15 Big bank muscle? FinTech hustle. That's how Fifth Third brings you the best of all worlds, going above and beyond the expected, handling over $17 trillion in payments each year with zero friction.

Speaker 15 They've been doing it that way for 167 years, but they also never stop looking to the future to take their commercial payments two steps ahead of tomorrow, constantly evolving to suit the ever-changing needs of your business.

Speaker 15

That's what being a fifth-third better is all about. It's about not being just one thing, but many things for our customers.

Big bank muscle, then tech hustle.

Speaker 15 That's your commercial payments, a fifth-third better.

Speaker 16 When too much work bogs you down, Asana helps you handle it. That's because Asana is where humans and AI coordinate work together.

Speaker 16

AI makes it easy to hand off routine tasks, streamline workflows, and keep everyone focused on the work that matters most. That's how work gets handled.

That's Asana. Visit us at Asana.com.

Speaker 14 That's ASANA.com.

Speaker 1 This is Marketplace. I'm Kai Rizdahl.

Speaker 1 American car makers, or maybe a better way to say that, is companies that build cars in this economy, because the stat I'm about to give you covers foreign-owned car companies too that make cars here.

Speaker 1 They had a spectacular third quarter. More than 4 million new vehicles July through September sold, data courtesy of Cox Automotive and Edmonds.

Speaker 1 That is well above, you should know, the same period last year.

Speaker 1 However, comma, you look under the hood, if you will, and things are a little bit less rosy in part because those numbers were juiced by the federal EV tax credit that went away on the last day of the quarter.

Speaker 1 And as Marketplace's Henriette reports, there is also more going on in the car market than just that.

Speaker 14 At the Audi dealership that Daniel Cossett manages in Oakland, California, EVs were a hot item at the end of the summer.

Speaker 17 We started August with over 75 EV units in stock, and

Speaker 17 we wrapped up September with only three left in stock.

Speaker 14 Cossett says his firm marketed the end of the tax credit pretty heavily, but he also got a lot of buyers who already knew they had a hard deadline to get that discount.

Speaker 17 They know what they're looking for. They're pretty savvy, and people knew this was it.

Speaker 14 This is what Carl Brower, executive analyst at automotive information site iccars.com, calls the pull-forward effect.

Speaker 10 Anyone who was on the fence or seriously considering an electric vehicle purchase in the next three, six, nine months ran out and did it before the end of September.

Speaker 14 Cox Automotive expects over 400,000 EVs were sold in the third quarter, which would be a record.

Speaker 10 But now that the credit's gone, says Brower, we're absolutely going to see a massive drop in electric vehicle sales for the next few months.

Speaker 14 And that could have an impact on overall car sales. Because if you look beyond EVs, sales in the third quarter, especially September, were kind of soft, Brower says.

Speaker 10 An increasing number of people can't afford new cars, or they're taking out loans they probably shouldn't be taking out.

Speaker 14

Think 84-month loans, seven years. Those are getting more popular.

And the average monthly payment on a new vehicle is nearly $750.

Speaker 14 Pair that with low consumer sentiment right now, and it's not hard to see why Brower and other analysts don't expect a huge rush to dealerships around the holidays.

Speaker 14 At the same time, automakers are facing rising costs of their own from the Trump administration's tariffs, says Tyson Jomini, Senior Vice President of Data and Analytics at JD Power.

Speaker 18 We estimate it's about $40 billion of tariff costs that automakers are absorbing, and that is equivalent to nearly 40% of global profits in the auto industry last last year.

Speaker 14 So far, car makers are mostly not passing that on to consumers.

Speaker 14 Partly, Jomini says, because it's a competitive industry and every company has a different supply chain and a different level of exposure to tariffs.

Speaker 18 Just because you have that cost as an automaker from producing overseas doesn't mean your competitors do. And that is leading to very competitive price dynamics here in the U.S.

Speaker 14 But car makers probably can't eat those costs forever, assuming the import taxes stay in place, says Jonathan Smoke, chief economist at Cox Automotive.

Speaker 19 We would suspect that once we get into the new calendar year, 2026, you'll see some increases in those stickers of the vehicles that are then being delivered to dealer lots, you know, in time for the spring.

Speaker 14 And the models that are especially exposed to tariffs, Smoke says, are the most affordable ones, vehicles currently under $30,000, because they're more likely to be assembled or include more parts from outside the U.S.

Speaker 19 Hiking the cost of those cars and SUVs and crossovers clearly challenges things for the consumer who's already stretching just to be able to afford a vehicle in that price point.

Speaker 14 One bright spot the car industry could look forward to, after the GOP tax bill passed this past summer, tax refunds for many Americans could be substantial, Smoke says.

Speaker 19 It's amazing what cash in pocket does to vehicle demand and activity.

Speaker 14 But until then, it could be a long winter. I'm Henry App for Marketplace.

Speaker 1 Like probably most of you, I turn on a tap in my house and I expect clean, clear water to come out of it. Not so for the estimated 1.1 million Americans who live without running water.

Speaker 1

That's according to the journal Nature Cities. And it gets me to this.

What is normal depends a whole lot on where you live. Here's today's installment of our series Adventures in Housing.

Speaker 13 My name is Caitlin Lenahan and I live here in Fairbanks, Alaska.

Speaker 13 Here in Fairbanks, it's not terribly uncommon to live in what we call a dry cabin, which means that I don't have running water.

Speaker 13 Because it can be negative 40 here in the winters, it just causes lots of things to break. So it's also an option, not just for cost reasons, but also for practicality.

Speaker 13 Where I live right now looks almost like a small house. It has drywall, a stove,

Speaker 13 and a counter with a sink in it. But on the sink, there's no faucet, and under the sink, there's no pipes that go anywhere.

Speaker 13 So instead, what I've done most of the time is just use a five gallon blue jug with a spigot

Speaker 13 as kind of like my running water. And then there is a bucket under the sink that catches gray water and then later on I go and dump that outside.

Speaker 13 So when I want water, when I need water, I actually need it today.

Speaker 13 I have four five gallon blue jugs that have like handles and little white spouts on them that I take either to a spring, which is my favorite place, but it's a little further out the road for me,

Speaker 13 or to a water wagon in town.

Speaker 13 And then, as far as showering, I've previously worked places that had showers at the offices, or like the university has showers.

Speaker 13 A lot of students, especially, live in dry cabins, and then you can also get a gym membership for pretty cheap. There's also laundromats have showers.

Speaker 13 I've been living without running water for eight years. I go through periods where I promise myself that I won't have blue jugs soon.

Speaker 13 But ultimately, like I think like my living situation, my community that I live in is so great, I don't see myself leaving there unless something like drastic were to happen.

Speaker 13 Like a lot of people say, oh, I could never live that way or I could never have like the outhouse or, you know, all these like, oh, God, situations. But I think people surprise, you can be surprised.

Speaker 13 People surprise themselves. It's really amazing what we can get used to.

Speaker 13 There's a learning curve for sure, but it happens fast.

Speaker 1

Caitlin Lenahan in Fairbanks, Alaska. High temperature there today, by the way, 38 degrees, positively positively balmy.

Tell us, would you, about the learning curve on your home?

Speaker 1 Marketplace.org slash adventures in housing.

Speaker 1

Just final note on the way out today. I just want to circle back to where we started, the new challenges to this economy presented by the president's trade policy.

Stocks got clobbered, as I said.

Speaker 1 Oil to the U.S. benchmark West Texas Intermediate, down more than 4% on the data $58.82.

Speaker 1

Expectations of slower economic activity is the causal factor there. The dollar down as well.

Gold, though. Hello, Safe Haven.

Bounced back up over $4,000 an ounce.

Speaker 1 And we talked about the 10-year, right?

Speaker 1

Our theme music was composed by B.J. Lederman.

Marketplace's executive producer is Nancy Fargoi. Joanne Griffith is the chief content officer.

Neil Scarborough is vice president and general manager.

Speaker 1

And I'm Kyle Rizzal. Have yourselves a great weekend, everybody.

We will see you back here on Monday, all right?

Speaker 1 This is APM.

Speaker 10 Michael Lewis here.

Speaker 20

My best-selling book, The Big Short, tells the story of the buildup and birth. of the U.S.

housing market back in 2008. A decade ago, The Big Short was made into an Academy Award-winning movie.

Speaker 20 And now I'm bringing it it to you for the first time as an audiobook narrated by Euros Truly.

Speaker 20 The Big Short story, what it means to bet against the market, and who really pays for an unchecked financial system, is as relevant today as it's ever been.

Speaker 20 Get the Big Short now at pushkin.fm slash audiobooks or wherever audiobooks are sold.