Marketplace

Every weekday, host Kai Ryssdal helps you make sense of the day's business and economic news — no econ degree or finance background required. "Marketplace" takes you beyond the numbers, bringing you context. Our team of reporters all over the world speak with CEOs, policymakers and regular people just trying to get by.

Episode library (216)

The weather outside is frightful (so's the heating bill)

The average cost of heating is expected to jump more than 9% this winter, according to projections from the National Energy Assistance Directors Association. In this episode, why energy bills are up —...

The job market won't start fresh in 2026

The labor market has been tightening all year, and Americans have grown increasingly anxious about their ability to find new jobs. A bit of good news? New unemployment claims fell last week. But that...

U.S. GDP sees healthy growth

From July through September, U.S. gross domestic product rose 4.3%, the highest in two years. At a time when many consumers are feeling economic pressure, higher earners and certain businesses are...

U.S. dollar down, gold hits all-time high

Gold surpassed $4,400-per-ounce for the first time Monday. Prices are up 60% in 2025. In the same year, the value of the U.S. dollar slipped 9%. What gives? In both cases, economic and geopolitical...

The 2025 consumer sentiment rollercoaster

Consumer sentiment really ran the gamut this year. But right now, Americans are feeling almost as bad about the economy as they were when inflation was at its peak summer of 2022. In this episode, we...

That CPI report got a Black Friday discount

November inflation data came in lower than expected, according to the latest CPI report. But we can’t compare it to the previous month, since the BLS skipped several October reports. And data...

Oil flow or oil freeze?

A U.S. blockade of Venezuelan oil tankers may sound disruptive, but global oil is plentiful, and Gulf Coast refiners remain tied to Venezuela’s heavy crude after decades of investment. If sanctions...

Unemployment hits four-year high

The U.S. unemployment rate climbed to 4.6% in November, according to the latest BLS jobs report. There’s also data showing more Americans are reentering the workforce and more part-time workers are...

Time to strike out on your own?

IRS filings for new business applications have been climbing the past few months — particularly in the retail sector. The last time we saw a spike like this was in 2020. Are Americans ditching the...

The stock market isn't the economy — but it's not nothing either

While markets are mellowing a bit, three major stock indexes closed at record highs on Thursday. Reminder: The stock market is not the economy! But it still can tell us how investors — and by...

Why the Fed is thinking about immigration

Federal Reserve Chair Jay Powell’s latest presser was all about the job market. Buried among the usual talking points, like hiring sentiment and the unemployment rate, was immigration. That’s because...

Fed rate cut diverges from global central bank strategy

The Federal Reserve cut its key interest rate Wednesday by a quarter point. That’s pretty much what analysts expected. But in other parts of the world, central banks have been signaling that they plan...

The great decoupling

When revenue grows, hiring grows — usually. But in November, retail sector job cuts were up nearly 140% year over year, according to outplacement firm Challenger, Gray & Christmas, in spite of...

What's in the long-awaited farmer relief package

We now know some details about the Trump administration’s promised agricultural relief package. Central to the plan is billions in one-time payments to U.S. farmers, who have been hurting under new...

Small businesses walk an affordability tightrope

Small business owners know affordability is top-of-mind for their customers. But as margins grow narrower, keeping prices as-is isn’t always possible. In this episode, we hear from a few small...

What's next for the Fed?

Changes are afoot at the Federal Reserve: President Donald Trump will name a new Fed chair in the coming year, and the central bank’s job could get complicated as the economy absorbs the full impact...

Small businesses pull back on hiring

Small business owners’ economic moods remain mixed. But, as is so often the case, how folks feel is different from how they act. And hard data tells us small business owners are pulling back on hiring...

A Fed divided against itself

The Federal Reserve’s quantitative approach to monetary policy decisions means its governors tend to reach consensus. But in the past few meetings, some FOMC members have disagreed on whether to...

Too much oil, too little demand

The Organization of Petroleum Exporting Countries will hold oil production steady next quarter as global supply remains unusually high, driven by record output from the U.S., Brazil, Canada, and...

'Tis the season for credit card debt

Holiday spending tends to drive up U.S. consumers’ credit card debt. In the past, most households were able to pay down that debt come the new year. But as wallets get squeezed, that may not be the...

Holiday hiring doldrums

Retailers don’t seem to be looking for many temp workers this holiday season. But it’s not the only sector that hires winter workers — event venues, transportation and warehousing still have some...

Predicting the Fed's every move

Yields on government bonds can tell us how investors think the Federal Reserve will act. In this episode, we break down what falling yields on short-, medium- and long-term Treasuries tell us about...

Much ado about affordability

“Affordability” — it’s a hot-button issue across the political spectrum. But how does one define or quantify a subjective idea? We called up a linguist and a few economists to hear their thoughts....

Are more Americans working multiple jobs?

The delayed-by-the-shutdown September jobs report showed a stronger-than-expected monthly gain of 119,000 jobs, seasonally adjusted. But dig into the data, and signs point to many of those jobs being...

Feeding the Family (bonus episode)

For many people gathering around the table this holiday season, things feel a little different. Maybe it’s the cost of ingredients that’s on your mind, or cuts to USDA funding that have left your food...

Off-price retailers shine as consumer moods sour

TJX, the parent company of off-price retailers T.J. Maxx, Marshalls, and HomeGoods, posted excellent earnings this week, while Target cut its sales forecast. “Off-price” means TJX sells excess...

The long-awaited September jobs report arrives

The September jobs report finally arrived after a six-week delay, showing employers added 119,000 jobs — well above expectations. The BLS also recorded an unusually strong 80% employer response rate,...

Too little, too late?

China's purchase of 1 million tons of U.S. soybeans ends a trade war freeze. And while it's better than nothing, it's still far below typical November numbers. With no confirmation of more big...

Rural hospitals were already short-staffed. Then came Trump's H-1B visa fee

The White House’s $100,000 fee on new H-1B visa applications is adding extra pressure to health care systems in rural and low-income areas. Historically, the visa has been a critical pipeline for...

Why we've got an eye on this week's corporate earnings

A few big box retailers report earnings soon, including Target, Walmart and Lowe’s. That could give some clarity on the state of the American consumer as we head into the holiday shopping season....

Trump's tariff turnaround

The latest in President Donald Trump’s trade war waffling? Tariff exemptions aimed at lowering Americans’ grocery bills. Affected products could include supermarket staples, like coffee and bananas...

What happens when the data takes a month off?

With the government shutdown officially over, the Bureau of Labor Statistics is back at work after a 43-day hiatus. But all that missed data can’t be recreated — and catching up while understaffed...

Are we spending more because we can, or because we have to?

Consumers may have revved up their spending in October, but spending more doesn’t mean getting more — prices are also up this holiday season. In this episode, why most shoppers feel like they're doing...

More labor market blues

Business owners aren’t too optimistic about the labor market, according to an NFIB survey. About a third are struggling to fill an open position, and around a quarter said labor quality was their most...

Where we're at with tariffs and inflation

Despite expectations surrounding President Donald Trump’s tariffs, inflation doesn’t seem to be speeding up — though it’s hard to say for sure without all that reliable federal data. You can thank...

Consumer sentiment hits three-year low

Consumer sentiment — as in, how everyday people feel about the economy — fell to a low not seen since 2022, according to the University of Michigan’s Surveys of Consumers. The decline was consistent...

A 20-year record for job cuts

The firm Challenger, Gray & Christmas counted over 153,000 job cuts in this country last month — the most October layoffs since 2003. Are companies pivoting to save money in light of over hiring...

The job market keeps flashing warning signs

With no government jobs data available during the shutdown, analysts have turned to private reports for clues about the labor market. In the latest round, ADP said private companies added jobs in...

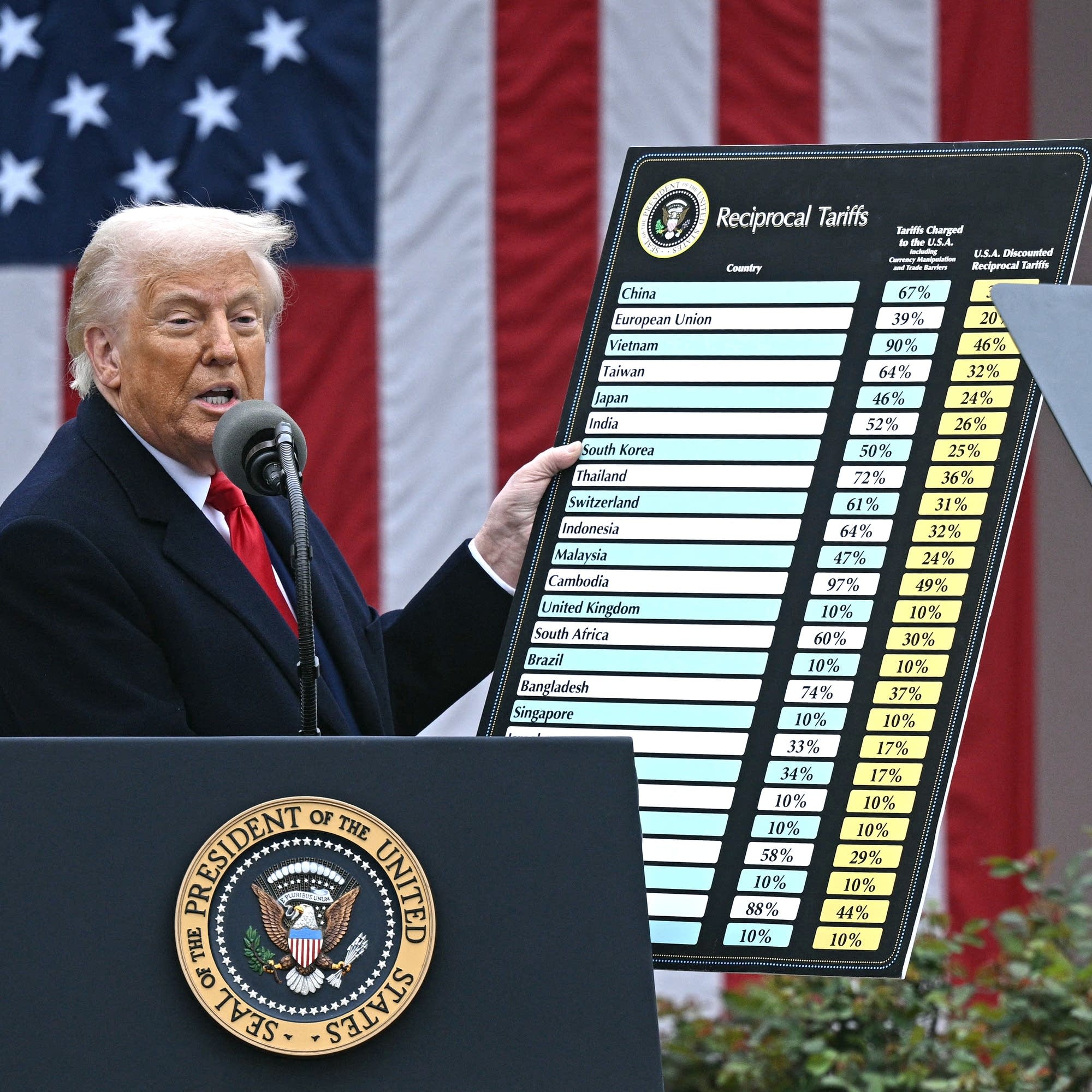

What to know as SCOTUS weighs Trump's tariffs

The U.S. Supreme Court will hear arguments on Wednesday for and against the legality of President Trump’s signature economic policy: tariffs. In this episode, a lawyer walks us through what’s at stake...

How long until SNAP reaches kitchen tables?

The Trump administration has been court ordered to partially fund this month’s SNAP benefits, after refusing to step in during the shutdown. Emergency USDA funds will cover about half of the $8...

How the economy went "K-shaped"

The U.S. economy is increasingly “K-shaped.” That means the gap between the wealthiest companies and consumers, and ... everyone else, is growing. Big Tech companies rake it in while smaller firms...

The case of the missing GDP report

With the government shutdown delaying the Bureau of Economic Analysis' third quarter GDP estimate, economists turn to Fed models and private analysts. The verdict? The estimates vary but generally...

Nvidia: Boom or bubble?

Nvidia's market valuation surged to $5 trillion Wednesday, breaking records. The chipmaker is on fire, and it’s using its glut of resources to invest in other tech firms that need those chips. But if...

AI is here. Where are the new, better jobs?

Amazon and Chegg both announced layoffs this week; Chegg says AI competition was a factor, and Amazon’s CEO alluded to AI-related job cuts earlier this year. History tells us when a new technology...

A sluggish spin cycle

The shutdown has delayed October's durable goods report. But fear not! Michigan-based appliance manufacturer Whirlpool reported earnings today, and they were pretty tepid. What does that tell us about...

Not everyone’s stretching the dollar the same way

Consumers everywhere are trying to stretch their dollars to compensate for economic uncertainty and inflation. However, there’s a divide between higher and lower earners. In this episode, we look at...

The national debt hit $38 trillion, and yes, you should care

The U.S. national debt hit a new record this week: $38 trillion. As we head toward the fifth week of a government shutdown over a congressional budget disagreement, we explain why the growing national...

Why is Trump throwing money at the Argentine peso?

The U.S. just agreed to spend $20 billion on a currency exchange with Argentina. The hope? To put a lid on inflation before Javier Milei, an ally of President Trump, is up for re-election. How does...

What are corporate outlooks without federal data?

Tons of major companies are reporting quarterly earnings and outlooks this week. But with federal data collection on hold, firms don’t have all the usual context to evaluate what the future may bring....

How's that BLS data coming along?

Our picture of the U.S. economy grows fuzzier each day the government shutdown continues. The Bureau of Labor Statistics, which publishes the most reliable economic data, has been a barebones...

Regional banks are doing alright, actually

Two midsize U.S. lenders claimed they were victims of loan fraud this week, sending bank stocks into a tailspin. But by close Friday, markets evened out — and for good reason: Regional banks, overall,...

CEO confidence sinks

CEO confidence fell in the latest quarter of 2025. Executives surveyed by The Conference Board voiced concerns over inflation, tariffs, and global trade uncertainty. In this episode, how the economic...

Time for another supply chain slowdown

The U.S. retail and supply chain sectors are slowing down — September’s Logistics Managers’ Index hits its lowest point since March. Many retailers are stopping shipments after stocking up early to...

Big banks' boom time

Amid all the anxiety, uncertainty and flip-flopping in this economy, one sector is doing tremendously: Big banks. Recent earnings reports showed banks including Citibank and JPMorgan beat revenue...

Trump's tariffs take a toll

In another wave of tariff news, Trump announced a 100% tariff on Chinese goods that will take effect in November. The constant back and forth of tariff policy has left import-reliant business owners...

The deal with "back door" betting

Wanna put a wager on, well, just about anything? Try a prediction market. Competing industry giants Kalshi and Polymarket both saw major investment this week, and for good reason. Though they don’t...

Greenback gains

The value of the U.S. dollar has been on the rise after months of decline. Political turmoil abroad has hurt other currencies, while easing rates and resilience at home have helped stabilize the...

Our economic future is a black box

Know how the government shutdown put the kibosh on federal data distribution, like last week’s cancelled September jobs report? Well experts haven’t just had a tough week of interpreting this economy...

Filling the federal data void

The federal government shutdown drags on this week, leaving a labor data vacuum. Private firms are hoping to fill the gap with their own data sets — some are even offering ‘em for free. Unfortunately,...

Are AI financing loops efficient or alarming?

OpenAI announced it will invest big time in chipmaker AMD, potentially in exchange for a stake in the firm. As AI investment has ramped up, similar deals have become common. Do these partnerships...

The 'K' in 'K-shaped economy' stands for 'kitchen'

The gap between how high-income and low-income Americans are faring in this economy is growing. One example? Fast food restaurants are struggling while sit-down joints that cater to wealthier...

On track for a layoffs record

The U.S. is on track for the largest number of announced layoffs since 2020. Yay us! (Kidding.) We can thank a combination of federal cuts and their ripple effects, an uncertain trade environment, and...

The data dogs are howling

The government shutdown means crucial jobs data will likely be postponed, right as the Fed weighs its next move. Chicago Fed President Austan Goolsbee, a self-described “data dog,” tells us how...

The "stuck economy," tariffs and Wall Street

While the stock market appears unconcerned about potential red flags in this economy, the bond market's a bit more cautious. As Washington nears a shutdown and the labor market flags, Treasury...

The housing market is "locked in"

Pending home sales rose in August, boosted by a slight drop in mortgage rates. Overall, though, the market remains sluggish — owners don't want to give up their locked-in low rates and buyers are...

Consumer spending outpaced income — again

In August, Americans spent more than they made for the third month in a row. Thanks to tariff-induced price bumps, consumers are dipping into savings and using credit cards to keep up with their...

A quick GDP refresher

Turns out the economy grew faster than we initially thought in the second quarter of 2025. Between a slowing job market and uncertain trade policies, an upward revision to GDP came as a bit of a...

What's with the streaming price hikes?

Disney’s streaming platforms — Disney+, Hulu, and ESPN — will see price hikes come October 21. They aren’t alone. As the streaming wars escalate, companies have switched focus to profit over customer...

Rate cut? So what?

Newly appointed Fed governor Stephen Miran has argued the federal funds rate should be a full two percentage points lower than its current level. A major cut like that could lower bond yields and...

Who's got the pricing power?

Economic data reports tell us two things are true: Inflation seems here to stay, and consumers haven’t let up on spending. It’s the perfect storm for businesses to wield the power to raise prices...

Google raises the stakes of the AI race

Google announced it will integrate Gemini, its AI assistant, into the Chrome web browser. That will transform Chrome — the most used search engine — into an “agentic” browser. More on what that means...

The job market's bizarre balancing act

The number of new hires in August was about equal to the number of Americans who lost or quit their jobs in the same month. That means they sorta just .... cancel each other out. In this episode,...

Hey, big spender!

The top 10% of earners in the U.S. accounted for nearly 50% of spending in the second quarter — the highest share since Moody's Analytics began collecting the data in 1989. That's important context,...

The cost of GOP cuts to coal royalties

Wyoming made billions from coal mining over the last 50 years, funding the government, schools, roads, parks. But President Trump’s major spending bill, passed in July, gives mining companies a break...

The slow death of remote-only jobs

It’s been five-and-a-half years since lots of workers retreated to home offices at the height of the pandemic. Now, about 35% of Americans work from home at least once a week. In this episode, why...

Small firms cross their fingers for a rate cut

The Russell 2000, a stock index of smaller companies or “small caps,” has fallen behind the S&P 500 over the past few years. A Fed rate cut, which may come as soon as next week, could change their...

As the job market slows, inflation speeds up

The labor market has been cooling for a bit, and in some sectors is virtually frozen. That could push the Federal Reserve to cut interest rates. But the Fed’s other mandate, besides maximum...

Why have some prices stayed put?

Consumer prices have been overall slow to reflect the Trump administration’s new tariffs. So we called up some retailers to understand why they haven’t raised their prices, even though their costs are...

The BLS has a $700 million budget. What's its ROI?

Budget cuts may be in the Bureau of Labor Statistics' future. But the data collected by the BLS is critical for federal decision making. In this episode, we calculate if the $700 million investment is...

The price of limiting trade with China

China's exports to the U.S. are down a third year over year. That’s a significant drop, reflective of President Trump’s punishing tariff agenda. Although China’s overall export growth has slowed, it...

Jobs report warning signs

Paltry job creation was the headline item in the latest jobs report. But dig a little deeper, and warning signs show up all over: long-term unemployment, Black unemployment and Hispanic unemployment...

What about the regional Feds? What do they do?

The Federal Reserve Board of Governors has gotten a lot of attention lately — President Trump is attempting to remove one member and has nominated another. But there’s more under the central bank...

Slo-mo jobs growth

Job growth has slowed this summer as employers ride out President Trump's economic shakeups. Thanks to uncertain tariffs, funding cuts, and the immigration crackdown, most companies aren’t eager to...

Short-term corporate borrowing climbs

“Commercial paper” is a type of short-term debt that’s paid off much faster than a typical corporate bond. It’s kinda like an afternoon snack — perhaps not great for you, but it’ll hold you over until...

No, private data can't replace the BLS

As the Trump administration strips away federal data collection agencies' funding and pressures statisticians to produce positive reports, we might wonder whether private data can fill in the gaps....

Sticky inflation, Fed drama and the rise of 'cute' debt

Core inflation rose to 2.9% in July, according to the latest PCE data — the Fed's preferred inflation gauge — marking its highest level in months. But despite stubborn inflation and falling consumer...

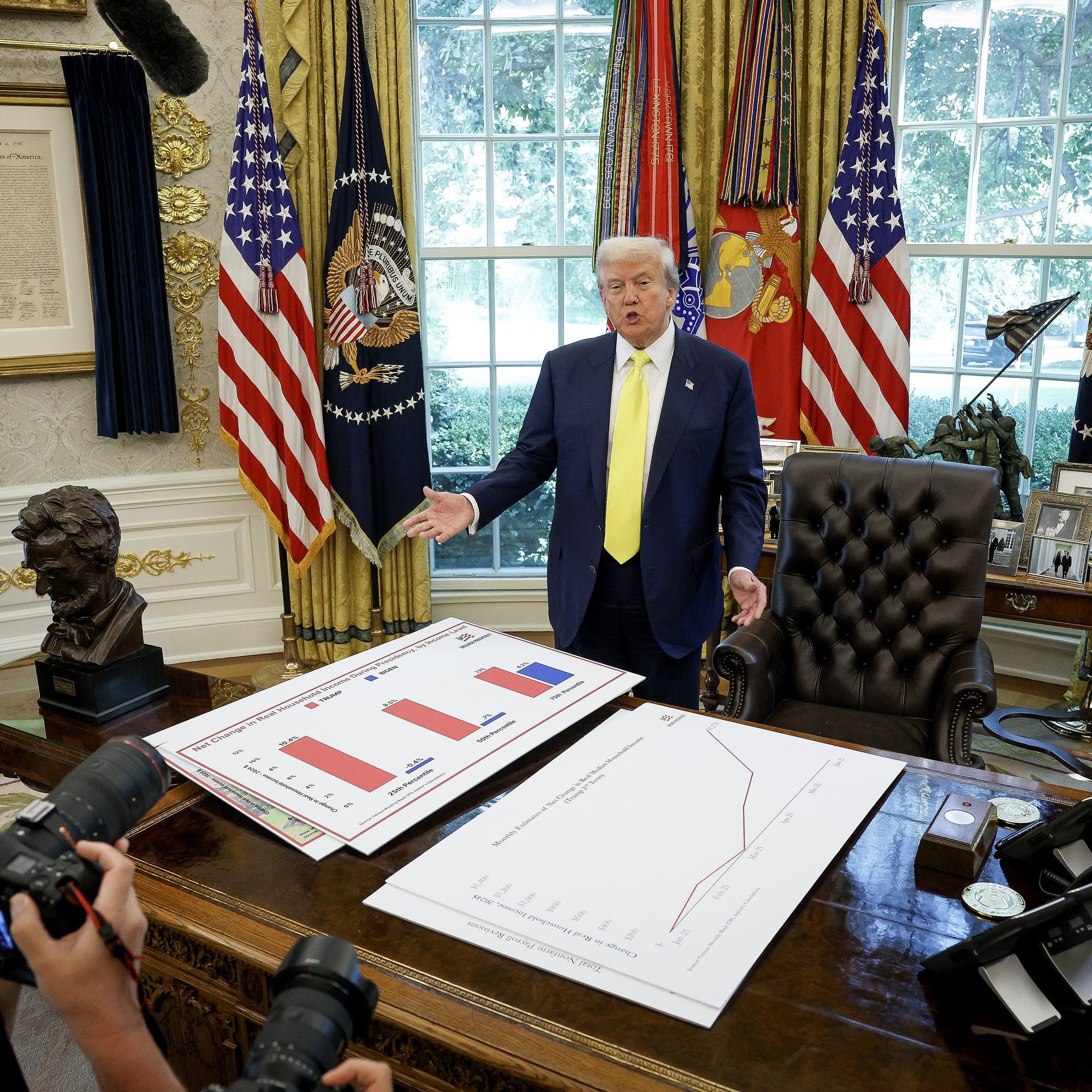

What's really going on in the Trump economy?

The U.S. economy grew faster than expected in the second quarter of the year, with GDP revised up to an annualized 3.3% from April through June. We take a closer look at what's driving those numbers,...

The relationship between consumer mood and spending? It's complicated

On Tuesday, the Conference Board reported a slight drop in consumer confidence, driven by worries about available jobs and future incomes. But a dip in confidence doesn't always mean people spend...

Can the president remove a Fed governor?

Late Monday, President Trump announced plans to remove Lisa Cook from the Federal Reserve Board of Governors over unproven allegations of mortgage fraud. The move is part of his months-long effort to...

For every action, something can go sideways

President Trump's recent deal with Intel gives the U.S. government a 10% ownership stake in the company. But today, Intel responded with a regulatory filing, outlining all of the ways this deal could...

Special Coverage from "Marketplace": The Real Costs

These are tumultuous times in the economy. There is inflation, a weakening job market, and uncertainty over tariffs and other federal policies. But the headlines don’t capture the real costs of...

Chili's is back (baby back, baby back)

Brinker International, which owns casual dining chain Chili’s, just beat 50-year sales and revenue records. In this fickle economic moment, how’d they do it? The answer involves viral fried mozzarella...

WWJPD?

Rising unemployment claims will be on Fed Chair Jay Powell's mind when he addresses the Jackson Hole Economic Symposium on Friday, and as he contemplates an interest rate decision in September. But...

Consumers embrace their inner Maxxinista

A consumer vibes indicator, in the form of two Q2 earnings reports: TJX (which owns TJ Maxx, HomeGoods, and Marshalls) raised its outlook for the remainder of the year after beating expectations. Over...

Flat pay raises are a sign o' the times

In this uncertain economy, employers want to save where they can. That’s likely why Starbucks just joined a growing list of companies to shift from merit-based raises to a flat percentage raise. In...

As many shoppers scrimp and stress, the wealthiest splurge

New context for the strong-consumer-spending-and-falling-consumer-sentiment combo: According to a Boston Fed report, the proportion of spending done by top-earning U.S. households is growing, and the...

Concerned consumers keep on spending

Recent data show moderate retail sales growth in July — a positive sign for our economy? On the flip side, consumer sentiment fell in an early-August survey. In this episode, why gloomy shoppers are...

Producers feel the pinch

Earlier this week, the July CPI report showed consumer prices remained steady, despite tariff noise. Today’s producer price index tells a different story: Wholesale prices grew a whopping 3.3%...

"Hacks" creators on collaboration, S5, and the state of comedy

HBO Max’s “Hacks” often tackles the push and pull between art and profit in the entertainment industry. It’s a topic the show’s creators are deeply familiar with. In this episode, “Marketplace” host...

Across regions and sectors, inflation zigs and zags

Ever read past the top line of the consumer price index? That 2.7% inflation rate varies a lot by metro area. The same goes for goods categories. So why is inflation higher in San Diego than Dallas?...

Tariffs muddy the future of the global oil market

If President Donald Trump’s tariffs stymie the U.S. economy — which would, in turn, slow the global economy — oil demand will fall. And we're already operating at a surplus. In this episode, why the...

In health care sector, dread over worker deportations

The U.S. health care sector will lose crucial long-term care providers if the Trump administration suceeds in slashing the Temporary Protected Status program. In this episode, we visit Massachusetts,...

Hear that? It's productivity number noise

American worker productivity grew a modest 2.4% in the second quarter of the year. Good news, right? Well, take a look at the math, and the last few months of falling imports and slowing workforce...

Should we fret over rising household debt?

The latest household debt report from the New York Federal Reserve is in. Delinquencies are on the rise — specifically, student loan delinquencies spiked into the double-digits. Experts say the news...

The oil-natural gas conundrum

The U.S. oil and natural gas industry is at a crossroads. As oil demand appears poised to plateau, natural gas demand is in a period of tremendous growth. The rub? Most U.S. natural gas is extracted...

Take it with a grain of salt

As President Donald Trump puts political pressure on the Bureau of Labor Statistics, experts worry BLS data will become less trustworthy. Economists following China say they know the feeling. In this...

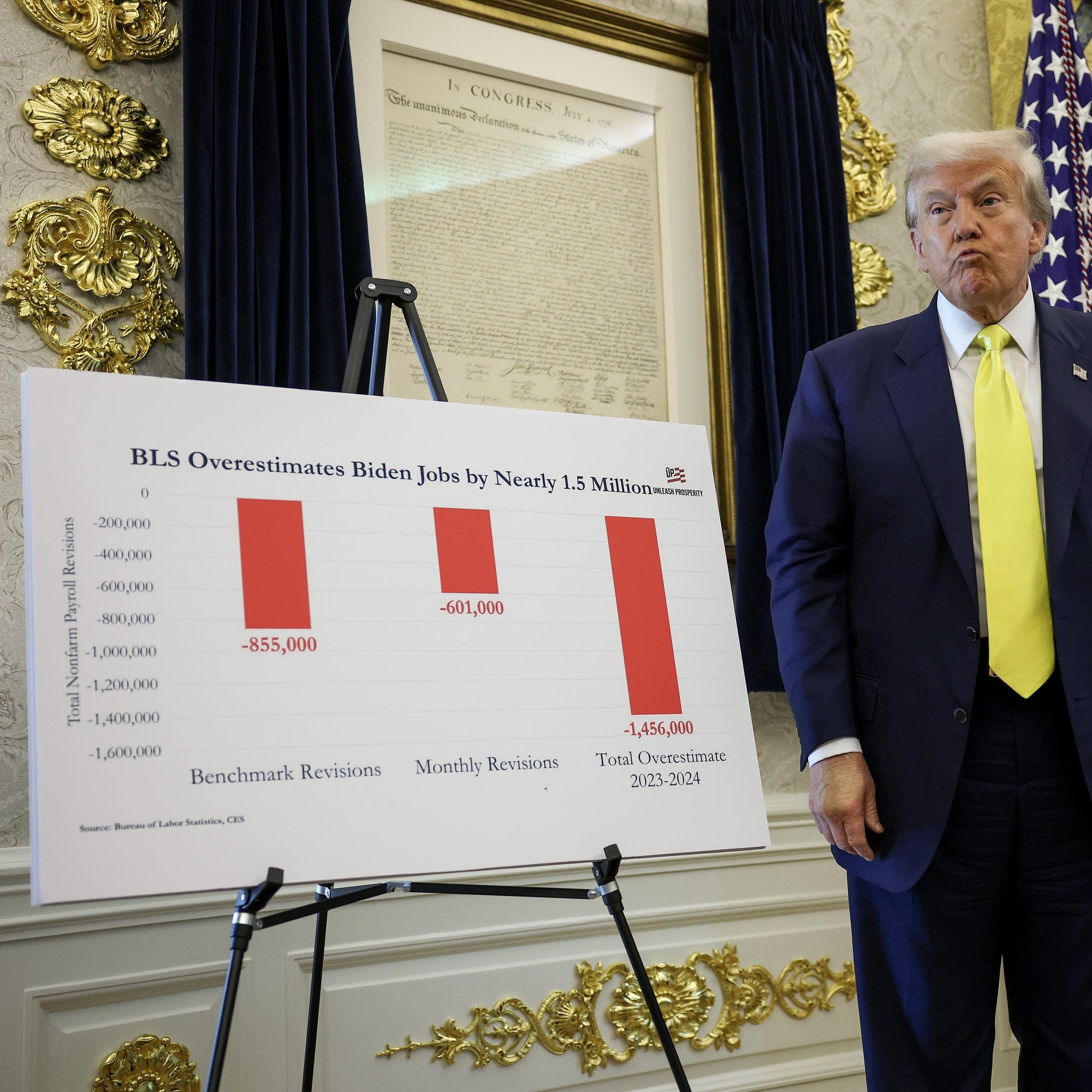

Trump's jobs report retaliation "raises alarm bells"

The Bureau of Labor Statistic’s July jobs report came in far below expectations. May and June’s counts were also revised down significantly. What’s a president — one who’s championed contentious...

Anomaly or omen?

Employers announced around 62,000 job cuts in July, according to a report from Challenger, Gray & Christmas. That’s up nearly a third from June, and more than double the number of July 2024...

Let's take a hard look at that GDP growth

U.S. GDP grew at a healthy clip in the second quarter of 2025. But a mathematical equation can’t convey nuance — like, say, six months of tariff chaos. Clear away the trade drama, and the country’s...

Consumers are still stressed about the job market

Consumer confidence ticked up in June, according to The Conference Board. At the same time, confidence in the labor market weakened for a seventh consecutive month. In this episode, what good are a...

How are lenders and borrowers feeling?

Since it’s unlikely the Fed will make any interest rate moves at this week’s meeting, it’s safe to assume rates will stay up for at least a while longer. That means potential borrowers are weighing...

AI and 'surveillance' pricing

Dynamic or 'surveillance' pricing is a relatively common practice. But what's changed is the sheer volume of our personal data available online, and how good AI has become at connecting the dots. With...

The dangers of fiscal dominance

President Trump wants lower interest rates now, but what could that mean for the economy? "Marketplace" host Kai Ryssdal speaks with Neil Irwin at Axios about the implications of Trump's push to cut...

A new trade deal with Japan

Under the new agreement, American consumers will now face a 15% tax on Japanese imports — a major jump from the 1.5% rate set back in 2019. The White House says making imports more expensive will...

What's at stake if the Federal Reserve loses its independence?

"Marketplace" host Kai Ryssdal speaks with Greg Ip at the Wall Street Journal about growing threats to the Federal Reserve's independence — and why it matters not just for the U.S. economy, but for...

Looking for economic clues in corporate America

We like to say it a lot here at Marketplace: the stock market is not the economy. But it can help tell us how the economy is doing — if people and businesses are spending or saving, investing or...

Will August bring a wave of trade deals or a hike in tariffs?

We’re starting to see the first real evidence of President Trump’s tariffs showing up in consumer prices. But are these manageable, one-time price increases or the early signs of runaway inflation?...

How immigration can bolster an aging workforce

As a nation’s workforce grows older, innovation and delayed retirement can keep economic gears turning. But so can immigration. In this episode, “Marketplace” host Kai Ryssdal and ADP’s Nela...

Can robots help us care for an aging population?

The number of people 85 years and older is expected to double in the U.K. over the next couple of decades. Apian, a London-based health care logistics company that partners with the National Health...

Want to understand our aging workforce? Look to the U.K.

By 2050, around a quarter of people in the U.K. will be 65 or older — about ten years before the U.S. reaches that milestone. For our ongoing “Age of Work” series, host Kai Ryssdal and ADP chief...

Who pays for tariffs?

Up and down the supply chain, companies are facing a dilemma: Should they absorb tariff surcharges and keep prices down, or pass on the cost to customers, and risk losing business? Most are taking a...

The GOP slashed $1 trillion from Medicaid's budget. What now?

The Medicaid budget just lost about $1 trillion. Eleven million more Americans will go uninsured, the CBO estimates, and those who remain Medicaid-eligible may lose coverage for "optional" services....

Reliable earnings outlooks? In this economy?

When companies release earnings reports, they often predict where they’re headed next, profit-wise. Lately, thanks to all that pesky economic uncertainty, some firms have altered their forecasts or...

Let's get a grip on the labor market

The June jobs report gave a sunny picture of the labor market. But if you’re, say, looking for a job right now, you may see things a bit differently. What gives? In this episode, we break down the...

RIP to the EV tax credit

A tax credit for electric vehicles was killed under the latest GOP tax and spending bill. It's a credit that has existed in some form for nearly 20 years. In this episode, how the tax break supported...

The consequences of tariff uncertainty

Trump officials signaled tariffs will be once again postponed, possibly to August 1. But as the White House nails down details, some businesses are suffering while they wait. In this episode,...

What happens when states manage public land?

Some conservatives think states should take over management of federal land. But often, states lack adequate resources, or use land for revenue rather than recreation or conservation. This...

Fear of ICE raids keeps California farm workers on edge

On California farms, ICE raid fears persist — at least half of the state’s crop workers are undocumented. As a result, the farms that grow three-quarters of U.S. fruits and nuts are experiencing...

Reading the labor market tea leaves

Consumer spending sputtered in May, likely thanks to tariffs and related uncertainty. Not only does that give us a clue as to where GDP is headed, it could also help us predict the labor market's next...

Time for a national debt history lesson

The Senate just narrowly passed the latest version of the GOP tax and spending bill, and the House will vote on it tomorrow. Nonpartisan experts at the Congressional Budget Office say the bill will...

An American manufacturing road trip

Several regional Fed offices reported soft or stagnant manufacturing activity this spring. Tariffs, immigration policy and other uncertainties are driving pullbacks across the sector. In this episode,...

All eyes on the inflation data

It's been a big week for economic data, with key reports on GDP, PCE, retail sales and consumer sentiment numbers. Bloomberg's Kate Davidson and the Wall Street Journal's Greg Ip join “Marketplace”...

Finding work is tough in a stalled labor market

Continuing unemployment claims just hit nearly two million — the highest number since November 2021. There’s not much hiring right now and workers with jobs aren’t going anywhere. In this static labor...

Prepping for all possibilities

Just two weeks out from the Trump administration’s tariff pause deadline, no one is quite sure what to expect. In this episode, experts weigh in on what sort of deals the U.S. is likely to make and...

Consumers couldn't turn frowns upside-down for long

The Conference Board’s consumer confidence index dropped in June. That’s after a brief reprive in May from a monthslong downward slide. Uncertainty surrounding the job market, tariffs, that GOP tax...

Despite Iran conflict, U.S. oil production is unlikely to budge

After launching air strikes on Iranian unclear facilities over the weekend, President Trump posted to Truth Social, demanding that U.S. oil firms “drill, baby, drill.” Although ongoing conflict in the...

Auto repair shops struggle under Trump's tariffs

In the “tariffs the Trump administration has announced and actually put into long-term effect” category? A 25% tax on some automotive parts. In this episode, we visit an auto repair shop in Vermont...

Home sales grow less competitive

This spring, just 28% of U.S. homes sold above asking price, according to Redfin. That’s the lowest spring rate since 2020. The trend toward selling at or below asking price is good news for buyers....

Break glass in case of oil price shock

The Fed kept interest rates as-is today, and Chair Powell said policymakers are “well-positioned to wait” before making another move. But what if oil price shock, propelled by roiling conflict in the...

Food banks tackle summer break hunger

This is a busy time for food banks — without school breakfast and lunch programs, more families lean on them. But between millions of dollars slashed from the USDA budget and heightened deportation...

The Fed's got an interest rate decision to make

The Federal Open Market Committee meets later this week, and it’s pretty likely they’ll examine why tariffs didn’t drive inflation up in May. The good news? A slew of economic data coming out this...

Shipping costs are up. Thank Trump's seesawing trade policy.

When President Trump slapped sky-high tariffs on goods from China, exporters rerouted ships elsewhere. Now that those tariffs are on pause, shipping costs aren’t magically coming down — the cargo is...

No, the Fed should not stop paying interest on reserves

You might’ve missed it amid all the Congressional budget hoopla, but Senator Ted Cruz recently floated ending Federal Reserve interest payments, claiming it would save a trillion dollars over ten...

Tariff-driven price bloat hasn't arrived just yet

Prices rose 0.1% in May, according to the latest consumer price index — that’s less than some analysts anticipated. It seems tariffs haven’t quite hit consumers’ wallets yet. We’ll explain what might...

Tariff fears likely shrunk the GDP

When new gross domestic product data comes out tomorrow, economists expect we'll see the first GDP contraction in three years. But the report is backward-looking, so if the GDP did shrink, it will be...

Taxes due today on goods sold tomorrow

Though it’s hard to say how much tariff-driven sticker shock consumers can stomach, some retailers have begun raising their prices. Other companies are rushing to set up “foreign trade zones” which...

In this uncertain economy, gold shines

The stock and bond markets may tumultuous right now, but gold prices have been on a tear. This week, they hit an all time high of $3,500 an ounce. In this episode, why nervous consumers, investment...

Trump aims axe at community lender fund

The Treasury’s Community Development Financial Institutions Fund supports lenders in far-flung and underserved areas. It also made a laundry list of federal programs President Trump deemed unnecessary...

Say goodbye to affordable clothing

Trump’s tariffs will touch the vast majority of industries, but apparel — clothes, shoes, accessories — will be particularly impacted. Around 98% of clothing sold in the U.S. is imported, primarily...

No job? No office phone? Thanks DOGE.

Verizon lost nearly 300,000 monthly phone subscribers in the first quarter. The telecom giant put partial blame on ongoing government layoffs. Verizon will bounce back, analysts say, but its bad news...

Boeing aircraft, duty-free no more

The scale and volatility of the trade war may be surprising, but tariffs aren’t new — unless you’re an aircraft manufacturer. (A trade agreement eliminated duties on commercial jets in 1980.) Last...

Special Coverage from Marketplace: Selling America

Stop us if you’ve heard this before: We’re in an unprecedented economic moment. But this time really is different. America’s place in the global economy is shifting, and what happens next is going to...

A housing market dilemma

Some relief seems to have arrived on the housing shortage front — listings are up 9% compared to last year. But buyers who’ve been waiting for more properties to go on the market? Not many are biting....

Amid turmoil, firms cling to their employees

First-time jobless claims have been pretty stable since the start of March — unlike many other parts of the economy. President Donald Trump’s tariffs and immigration restrictions may not be ideal for...

Tariff anxiety turns fun splurges into stress purchases

We’ve heard about people rushing to replace big-ticket essentials ahead of trade war-related price hikes, but what about stuff that’s more of a want than a need? In this episode: Tariff anxieties...

Counting the ways tariffs disrupt our economy

For the first few years of the pandemic, businesses navigated a backed-up global supply chain that left some with excess inventory and others with no inventory at all. Tariffs may cause similar...

Office uncertainty — inside and out

Fear of unemployment jumped 4.6 percentage points to 44% in March, according to a New York Fed survey. That’s the highest it’s been since April 2020. Expect the commercial real estate market to feel...

Expect tariff evasion

Just like some people fudge the numbers to lower their taxes, some companies do the same when paying tariffs on foreign goods. The federal government is mostly trusting that what’s in that shipping...

Eyeing the bond market

Stocks aren’t the only assets in the financial markets that were beat up this week by President Trump’s tariffs. Bonds suffered too. After 3-year Treasury yields rose in the face of disappointing...

Acting on uncertainty

We’ve said it more than once lately: This economy is defined by uncertainty. And as President Trump makes aggressive, if erratic, moves on trade and federal funding, firms and organizations are taking...

A cold snap in corporate bonds

The issuance of corporate bonds has slowed to a crawl, thanks to all that uncertainty in the economy. And without raising money in the bond market, firms may pull back on long-term investments. Also...

Footwear will likely still be “Made in China”

Import levies on Chinese goods amount to 54% right now. But some things that China excels at producing will likely remain in China. In this episode, why shoemaking can’t up and leave anytime soon....

Who will tariffs hurt the most?

Tariff-driven inflation will hit Americans with the lowest incomes the hardest, slashing their disposable income by at least $1,700 a year, the Yale Budget Lab predicts. We’ll explain why. And the...

Reminder: Tariffs are taxes.

Uncertainty about tariffs and trade policy has been top of mind since President Donald Trump’s election in November. We finally know how high those tariffs will be (between 10% and 54%) and to which...

Q1 dealmaking takes a dive

Corporate dealmakers hoped merger and acquisition ventures would heat up this year. But the first quarter of 2025 saw the slowest M&A activity in more than a decade, according to Dealogic. In this...

The negative wealth effect

People feel richer — and spend accordingly — when their assets rise in value. That’s called the wealth effect. But when folks get their retirement account statements for Q1 of 2025, they may...

Will owning a home ever be affordable again?

Just how expensive has homeownership become? To afford a typical home, households need an income of about $117,000 right now — a 50% increase from $78,000 in January 2020, according to a Bankrate...

Are U.S. consumers finally running out of steam?

Consumers say they’re fed up with inflation, then they keep spending. But their behavior could be catching up with their anxiety, an economist told us. The clues are in data released today by the...

Uncertainty, thy name is tariff

The U.S. economy grew at a 2.4% annual rate in the fourth quarter of 2024, the Bureau of Economic Analysis reported today. That number tells us where the economy was headed coming into this year. But...

The law of unintended consequences

More tariffs are on the way, this time targeting vehicle imports. President Donald Trump favors import taxes, partly because, he argues, they’ll help shrink the U.S. trade deficit. But if...

Consumer confidence continues to dim

The latest reading marks the fourth straight month of declining consumer confidence, and it fell more than expected. How will the souring mood affect spending and the job market? Also in this episode:...

Will tariffs boost U.S. manufacturing?

The Donald Trump administration wants to strengthen U.S. manufacturing with tariffs on imported goods. We look at the latest purchasing managers report to see if new trade policies have made an...

Measuring a tax cut is all about the framing

We’re tackling a “mysterious and important” question in today’s episode: Should Congress use “current policy” or “current law” baseline when measuring...

These sectors are bracing for price hikes

More tariffs are set to take effect April 2, and in most cases, American consumers and businesses will pay the tax. We’ll explain why some sectors expect prices to rise as soon as next month...

Fed takes “wait and see” approach with tariffs

Federal Reserve policymakers aren’t cutting interest rates right now, though they expect two rate cuts in 2025. When — and if — those cuts come will depend on how the trade war shakes out. In...

Stress-Googling “recession”? You’re not alone.

“Recession” recently peaked on Google Trends — a sure sign Americans are sweating the possibility of an economic downturn. But what do the numbers say? Well, the hard data so far reflects...

Working 9 to 5 — and 6 to 11. Maybe weekends too.

About 8.9 million. That’s how many U.S. workers worked more than one job in February — an all-time high, according to the Bureau of Labor Statistics. We spoke with some workers holding multiple...

Will homebuyers spring at lower rates?

Mortgage rates have fallen recently to 6.6% for a 30-year fixed. But will it be enough to bring prospective homebuyers off the sidelines? Not according to one survey, which found some buyers are...

The weakening dollar

The U.S. Dollar Index has fallen sharply in the last few weeks, thanks largely to tariff flip-flopping and overall economic uncertainty. Typically, significant sustained changes in a currency’s...

Could economic feelings become fact?

Just 44% of employees feel confident about the next six months at their company, a Glassdoor survey found — the lowest in nine years. Thank government layoffs, tariff uncertainty and a toughening job...

Remember tariff exclusions?

Back in 2018 — the last time President Donald Trump led a trade war — some businesses got tariff exemptions if they imported goods that couldn’t be sourced in the U.S. Was the process to apply...

Selling a “completely destroyed” home

Terri Bromberg lost her home of 20 years in the Los Angeles fires. Rather than rebuild, the artist and professor chose to sell and move elsewhere. Prospective buyers put in bids without being able to...

The contrarian jobs report

Overall employment dropped last month, according to the monthly jobs report from the Bureau of Labor Statistics. At the same time, employers added jobs to the economy. Weird, right? Well, two surveys...

This isn’t the 2018 trade war

The Federal Reserve may be steering the economy through another trade war. But this time, the inflation of the last few years complicates its task. Also in this episode: Unemployed...

Uncertainty is a certainty

Ask an economist what’s driving decision-making right now, and the answer may well be “uncertainty.” In this episode, the unpredictable environment fuels a range of change: The labor...

Tariff pain and retaliation

They’re here: President Donald Trump’s 25% tariffs on goods from Canada and Mexico begin today, as well as an additional 10% tax on goods from China. In this episode, we hear from business...

Bird flu spreads its wings

As bird flu proliferates across U.S. farms, infecting chickens, cows and even humans, some public health experts worry that that funding to deal with it has been inadequate. Above all, they say we...

Will Hollywood’s behind-the-scenes workers stay?

In the past decade, filming outside of Los Angeles has become a cost-effective option for many major studios. And lower housing costs are driving many lighting techs, grips and gaffers to follow. With...

Hope or fear?

Capital goods orders picked up in January — that’s stuff businesses buy that’ll last a while, like tools and equipment. Is it a sign business owners have money to spend? Or, have tariffs...

The GDP equation

The second Trump administration has made spending cuts a priority — already, the president has enacted a funding freeze and laid off thousands of federal workers. Reduced government spending will...

A housing reality check

Home Depot, which makes most of its money from renovations, said small projects are driving its sales. That suggests homeowners are staying put — maybe improving the home they have while waiting for a...

Who’s in the consumer-spending driver’s seat?

The top 10% of earners account for half of all consumer spending in the U.S., a new study shows. In other words, if the goods and services Americans buy in a year were a pie, those with the highest...

Tumbling economic sentiment — especially for Dems

American consumers agree: High prices aren’t going anywhere. All that stress about inflation, and throw in the impact of tariffs, heightens uncertainty, which translates into negative economic...

Access to federal data in flux

Last month, key federal data sets were removed from government websites following actions by the Donald Trump administration, and researchers rushed to preserve the information. David Van Riper of...

Vote with your wallet

Nearly half of consumers say they’ve taken action to align their spending with their moral views since the November election, a new Harris Poll shows. That includes boycotting brands based on campaign...

How low can it go?

At the national level, 2.5% is the lowest the unemployment rate has ever been … and that was for just two months in 1953. We’re at 4% right now, but the labor market is pretty tight. In...

All these sellers, but where are the buyers?

Tons of sellers listed their homes in January, after months of waiting in vain for mortgage rates to fall. But many would-be buyers are facing economic uncertainty and aren’t ready to make an...

Do you buy the retail sales number?

Retail sales were down in January, but the Census Bureau report — with its mish-mosh of data — can obscure nuances in consumer spending. In this episode, we talk to economists and other experts about...

Time to sell!

Homeowners have been clinging to low mortgage rates for the past few years, stifling the housing market. But new data from Zillow shows once-patient sellers are finally pulling the trigger, despite...

What’s next for BP?

After a rough 2024, energy giant BP is expected to announce a “fundamental reset” of its business strategy this month. We don’t know for sure what that means, but industry experts...

Making waves

The sun isn’t always shining and wind isn’t always blowing, but what if there was an always-available renewable energy source? In this episode, we take a trip to the Port of Los Angeles,...

Some things haven’t changed

A series of policy changes are hitting the economy, but some aspects of consumer behavior have yet to demonstrate change. A Federal Reserve survey shows Americans still gauge future inflation at 3%....

Where did all the normal-priced stuff go?

When you’re shopping, ever feel like your options are low-quality budget items or stuff that’s stunningly unaffordable? The growing gap between the haves and have-nots in the U.S. is...

Trump’s bid to take down the 10-year yield

Treasury Secretary Scott Bessent says President Trump’s strategies of “energy dominance, deregulation and non-inflationary growth,” will bring down bond yields even if the Federal...

So, about those tax cuts from Trump’s first term…

In 2017, President Trump overhauled the federal tax structure. Eight years later, the corporate tax part of the deal hasn’t quite “paid for itself,” as promised. But the personal...

Yes, the U.S. owes itself money

You know that national debt we’re always talking about? It’s at $36 trillion right now, and around $7 trillion of that is owed … back to the U.S. government. We’ll explain....

Theme of the day: Uncertainty

Between President Trump’s changeable policy plans and sticky inflation in some sectors, everyone participating in this economy is, in a word, uncertain. In this episode, we hear how...

Employers pay up for health care too

Spent a lot on health care last year? So did employers. The cost of employee health insurance benefits rose 4 to 5% faster than inflation in 2024. That’s not unusual, but rising premiums do put...

The economy that could be

If you’re a regular “Marketplace” listener, you’ve probably heard of the Fed’s Beige Book. But have you heard of the Tealbook? In this episode, we pull back the curtain...

Cents and sensitivity

When the Federal Reserve changes its key interest rate, borrowing costs adjust accordingly … usually. There are times, though, when they move in the opposite direction. In this episode, we break...

Business opportunity and a tricky balance

As America’s population ages, so does its workforce. That’s why this week, Kai and ADP’s Nela Richardson are visiting Cumberland County, Tennessee, where a third of residents are 65...

Demographics are destiny

It’s a demographic reality: The U.S. has an aging workforce. That’s gonna affect our economy, big time. In this episode, Kai takes a trip to Cumberland County, Tennessee, with payroll firm...

House brands

Private label sales hit an all-time high in 2024, a new report shows. We’re talking about retail stores’ in-house brands, like Costco’s Kirkland or Target’s Everspring. What...

Still looking

Though first-time unemployment filings barely ticked up last week, continuing claims hit a high not seen since 2021 and nearly 1.9 million Americans are receiving jobless benefits. What gives? A mix...

Buy in bulk and on credit

How is the consumer-spending sausage made? Not impulsively — today’s shoppers are value- and credit-savvy. Procter & Gamble attributed its sales growth to bulk purchases against a backdrop...

That’s a headscratcher

President Donald Trump’s first day back in office came with dozens of executive orders and announcements. In this episode, we dig into why some of these decisions aren’t in domestic...

About this Podcast

Copyright

Copyright 2025 Minnesota Public Radio

Language

en