What to know as SCOTUS weighs Trump's tariffs

The U.S. Supreme Court will hear arguments on Wednesday for and against the legality of President Trump’s signature economic policy: tariffs. In this episode, a lawyer walks us through what’s at stake and how the major questions doctrine may come into play. We also consider whether it’s possible to repay the $90 billion accumulated in tariff revenue should SCOTUS rule against the president, and scrutinize potential ‘plan B’ tariff policies.

Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.

Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

Press play and read along

Transcript

Speaker 1 Are you looking to invest in municipal bonds? For extra protection, buy bonds insured by Assured Guarantee. It guarantees 100% of your principal and interest will be paid when due.

Speaker 1 Assured Guarantee has demonstrated its reliability and financial strength for nearly four decades. That's why the bonds they back are one of the safest investments you can make.

Speaker 1 Visit AssuredGuarantee.com. Assured Guarantee, a stronger bond.

Speaker 2 This podcast is supported by Odoo. Some say Odo business management software is like fertilizer for businesses because the simple, efficient software promotes growth.

Speaker 2 Others say Odoo is like a magic beanstalk because it scales with you and is magically affordable.

Speaker 2 And some describe Odoo's programs for manufacturing, accounting, and more as building blocks for creating a custom software suite. So Odoo is fertilizer, magic beanstock building blocks for business.

Speaker 2

Odo, exactly what businesses need. Sign up at odoo.com.

That's odoo.com.

Speaker 3 We are going to talk about one thing on the program today, one law. It's a mouthful, the International Emergency Economic Powers Act of 1977,

Speaker 3 how it's being applied here in 2025. From American public media, this is Marketplace.

Speaker 3

I'm Kai Rizdahl. It is Tuesday, today, the 4th of November.

Good as always, to have you along, everybody.

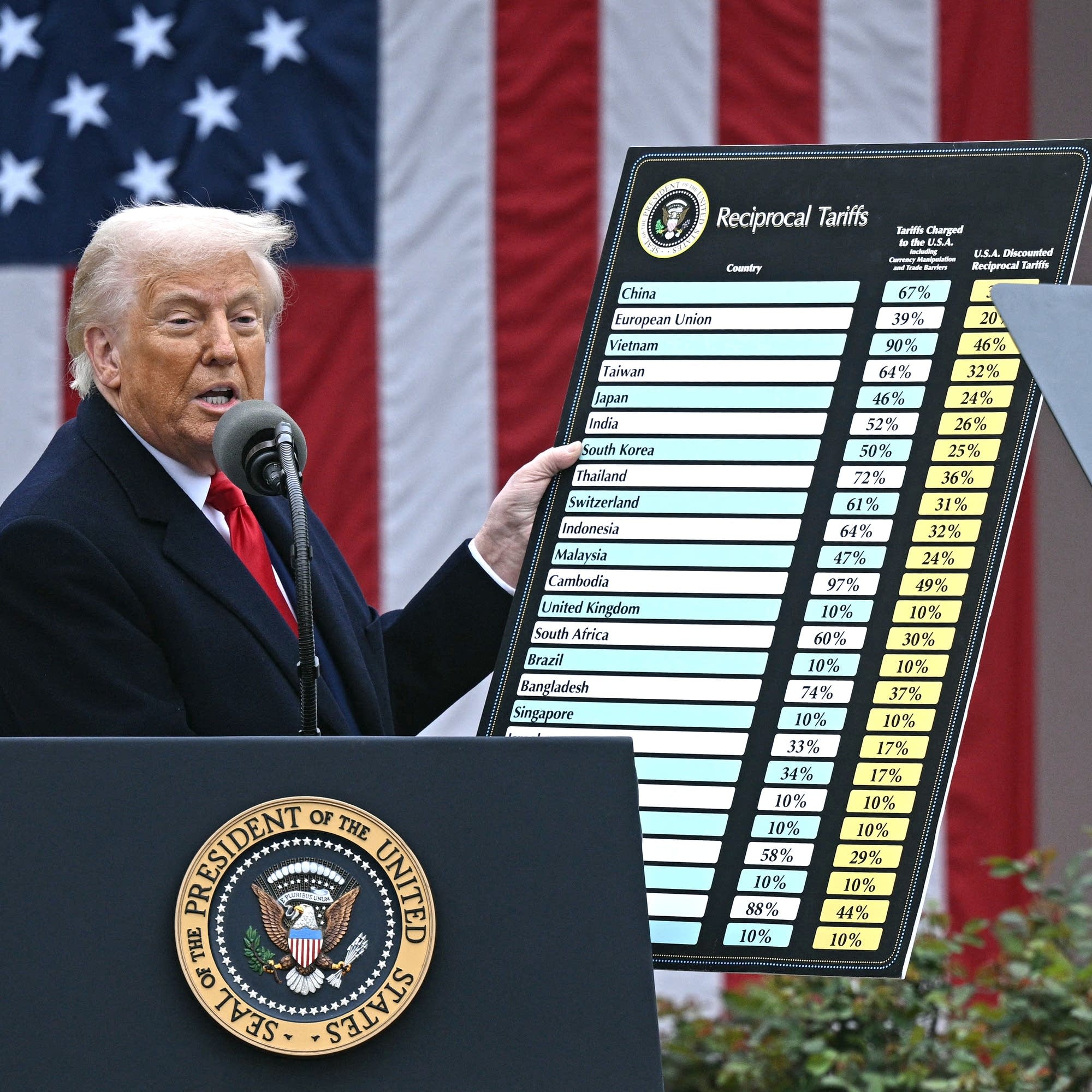

Speaker 3 As I said, we are going to do the whole program today on the law behind President Trump's tariff palooza back in April, those very nearly global import taxes that the president says he's allowed to do under the provisions of the aforementioned International Emergency Economic Powers Act, AIPA is the shorthand.

Speaker 3 And it is going to be the topic du jour at the Supreme Court of the United States tomorrow.

Speaker 3 We're going to hear from a law professor and some analysts and economists, but we are going to start with small business owners.

Speaker 3 It was small businesses that file the suits that are going to be heard tomorrow, and it's small businesses that are being hit most directly.

Speaker 3

Katie Lazar is the general manager at Kane Vineyard and Winery in Napa Valley. Todd Adams is the president of Santa Tube.

That's a stainless steel tubing supplier for food manufacturers.

Speaker 3

We caught him, I should say, at the Houston airport. Hello to you both.

Welcome to the program.

Speaker 6 Thank you.

Speaker 3 Thanks for having us. Todd, let me start with you, and it's going to be the same question to the both of you.

Speaker 3 How is your business today versus business, say, a year ago? How's it going?

Speaker 7 To be honest, business remains strong and we're thankful for that. It is a lot more challenging these days.

Speaker 7 Pricing has been much more fluid than it has ever been in the past, particularly on the product that is imported.

Speaker 7 And in our industry, a significant portion of the product is imported because there is no domestic manufacturing.

Speaker 7 We've had to increase prices and it's largely been It's largely been accepted by the market.

Speaker 7 Not sure how that's going to play out down the road because eventually that that will trickle down to the price of consumer goods and food products.

Speaker 3 Right.

Speaker 3 Katie Lazar, same question. How's business compared to a year ago?

Speaker 6 Very complicated. Basically, on the international side, selling internationally, we have lost 100% of our wine sales.

Speaker 3 I'm sorry, say that again. You've lost 100% of your international wine sales.

Speaker 6 That's correct.

Speaker 3 That seems challenging.

Speaker 6 It is. It is.

Speaker 6 And on the domestic side, as most listeners and you would know, we are having a difficult year that has nothing to do with the tariffs because there's a neo-prohibitionist movement, is one thing you could call it, around alcohol.

Speaker 6 So we're having to really work hard to make sure the fine wine that we make gets into people's glasses through the various channels that we have.

Speaker 3 Todd, do you think, you know, the president has said he wants to rebuild American manufacturing onshore American jobs.

Speaker 3 Do you think his tariffs are going to do that in a way that's going to help your company?

Speaker 7 In our industry, the effect would be minimal.

Speaker 7 There is some opportunity for domestic manufacturing. And we, in fact,

Speaker 7 even before the president came into office, we took advantage of that. We do manufacture in Lakeland, Florida, but some of the more basic products are made overseas.

Speaker 7

And that's for a multitude of reasons. But I hope those jobs don't come back to the United States because they're not attractive in many ways.

Right.

Speaker 3 As I said up at the top, we've caught you in an airport. I imagine you're on your way to, I don't know, check out a supplier, go to a trade show, right?

Speaker 3 What's the conversation on the ground with folks?

Speaker 7 Yeah, I'm actually, I'm headed to China today.

Speaker 7

I'm going to meet with old vendors and some potential new ones. I'm going to Asia, really.

I'm looking at sourcing from some other countries.

Speaker 7 So I'm essentially going because some of our vendors have sort of grown tired of dealing with the United States and with American companies, and they're looking at diversifying elsewhere.

Speaker 7 So I'm going to reinforce the relationships that I took a long time building and

Speaker 7 hopefully reassure them that we do still plan to work with them as much as possible.

Speaker 3 Katie, I imagine relationships are real important in wine. It's a very personal kind of product.

Speaker 3 How much of your time are you spending on building and/or rebuilding or finding new relationships for your product?

Speaker 6 Oh, I have been solid on the road since, well, August. Summertime for us is not a busy time, but

Speaker 6 our season basically is January through May and then August through December.

Speaker 6

This is the classic time when 40 to 50 percent of our wine gets sold. Most of our wine goes out through the wholesale channel, selling to restaurants and retailers.

And that means

Speaker 6 hosting wine dinners and meeting with buyers at restaurants, tasting them on the wine, and then moving on to another, you know, doing eight, ten restaurants a day.

Speaker 3 So if you have another year like this year has been for you where you've lost, as you said, 100% of your national distribution,

Speaker 3 are you going to stay in business?

Speaker 6 We're working very hard to, yes, we're doing okay.

Speaker 6 We've been around for 40 years.

Speaker 6 We're a very small niche business, and we have people who love what we do, but we have to work all the time to make sure that we're creating enough revenue to support ourselves.

Speaker 6 We lost 80% of our vineyards and all of our buildings in the glass fire of 2020. So while that is a disaster, we've been using this time to replant our vineyard and regrow our business.

Speaker 6 So that idea of a silver lining coming from something like that is what the mantra that we live with today.

Speaker 3 Todd Adams, there's an analogy there, right? They took the crisis that was the fire and are trying to figure things out anew.

Speaker 3 You are taking these tariffs and resourcing your products and trying to find new supply chains.

Speaker 7 This is a permanent change for you right i mean china is is big and and important but you're you're diversifying we are but you know i don't know what lies around the corner next for example we made a big push you know early on in this newly revamped trade war back in january february to um source a little bit more from india and then there was some tough talk on india that kind of came out of left field so We try to keep multiple irons in the fire because we don't know where we need to turn next.

Speaker 7 And I think the truth of the matter is, you know, we need to work with China. We need to work with the world.

Speaker 7 Sure, we need to solve some issues there, but we're not going to, hopefully not, going to just be an isolationist economy.

Speaker 3

Todd Adams at Santa Tube and Katie Lazar at Cain Vineyard. Different businesses, same kinds of problems.

Thanks, Chichu. I appreciate your time.

Thank you. Thank you, Todd.

Speaker 3 The trials and tribulations of small businesses were not top oh mind on Wall Street today.

Speaker 3 Instead, it was warnings from some of the big banks that, you know, just maybe company valuations might be a tad bit high.

Speaker 3 We'll have the details when we do the numbers.

Speaker 3 We come now to the legal portion of the program because, you know, it is a lawsuit.

Speaker 3 And as happens in high-profile cases, interested and qualified observers get to file briefs arguing one side or the other, amicus briefs, they are called.

Speaker 3 44 of them in this case, one of which includes as signatories 40 PhDs, four Nobel Prize winners, two former Fed chairs, that's Yellen and Bernanke, one former commissioner of the Bureau of Labor Statistics, five former chairs of the White House Council of Economic Advisors, Yellen is one of them, across both Democratic and Republican presidents, by the way, three former directors of the Congressional Budget Office, and one former Secretary of the Treasury.

Speaker 3 Hello, Janet Yellen, again.

Speaker 3 That's a whole lot of economic and policy expertise in one filing. So what, you may be wondering, did they have to say? Well, the whole thing is about 45 pages long.

Speaker 3 We'll spare you, but it points out that trade deficits, the president's basis for his declaration of emergency, are in fact normal.

Speaker 3

This is Economics 101, the brief says, but the implications are profound. That's a quote.

Exactly how profound, coming up in just a sec.

Speaker 3 There is more at stake in this case than just how a president can or cannot tariff and the billions or more in tariffs that are on the line, which is why we've called a professor of law and political science to go over the details with us.

Speaker 3 Blake Emerson is at UCLA. Blake, it's good to have you back on the program.

Speaker 5 Great to be here. Thanks for having me.

Speaker 3 For those of us in the audience who are not lawyers, what is

Speaker 3 the main question at issue in this case?

Speaker 5 The big question is whether the Trump administration has the power to impose tariffs on imported foreign goods under the International Emergency Economic Powers Act.

Speaker 5 And that statute empowers the president to regulate the importation of foreign goods in times of a national emergency.

Speaker 5 So the big question right now is: does the authority to, quote, regulate include the authority to impose a tariff?

Speaker 3 Okay, back to the legal complexities of this case. There is this thing called the major questions doctrine, which, as I understand it, again, not a lawyer, is a big deal in this case.

Speaker 3 Help us understand.

Speaker 3 For sure.

Speaker 5 The major questions doctrine is a very important rule of administrative law that the Supreme Court has deployed really energetically in the past several years, particularly during the Biden administration.

Speaker 5 And what the major questions doctrine says is that if the president wants to do something really big, if he wants to issue a policy of what the court calls vast economic and political significance, there must be explicit authority in the statute for that exercise of power.

Speaker 5 And so now the question is, does that same principle apply to Trump's efforts to impose tariffs?

Speaker 5 And one might think that it would, right? Because these tariffs are massive, they have huge economic effects, and the statute does not use the word tariffs or duties or tax. It uses the word regulate.

Speaker 5 So, you might think that the major questions doctrine would prevent what the Trump administration is trying to do here.

Speaker 5 But it's far from certain that that's going to be the result that the Supreme Court will reach, even though that is the result that the Federal Circuit reached in the opinion below.

Speaker 3 Am I overstating things if I

Speaker 3 say that this case really is about the way this economy is run? I mean, look, you and I have talked a lot of times about administrative law and how that's the way the economy is run.

Speaker 3 But this is kind of the same deal, right? This is how the economy is controlled.

Speaker 5 Absolutely. I think if you look at what the Trump administration is trying to do, it's trying to develop a new form of presidency-centered economic regulation.

Speaker 5 What's troubling, or at least novel, about that, is that there's a risk in this case that the Trump administration, if it gets the blessing of the Supreme Court, may create a kind of end run around the separation of powers.

Speaker 5 Because in this case, we're dealing with the power to tax. And the power to tax is vested explicitly by the Constitution in Congress.

Speaker 5 And if the president ends up having a kind of freestanding power to impose taxes, he'll be able to regulate through that mechanism.

Speaker 5 Because we often say that you can do most of the things, same things you could do with a regulation through a tax.

Speaker 5 Instead of saying you can't do this, you impose a tax of a large enough size that makes it prohibitively expensive to do that same thing.

Speaker 3 I was about to say

Speaker 3 one tries to guess what the Supreme Court's going to do at the risk of one's reputation, but this court does have a history the past year or so of siding with the president. Spitball this one for him.

Speaker 3 What do you think happens? Because as you said a minute ago, right, they've used major power, the major questions doctrine to strike down things that are far less economically significant than this.

Speaker 3 So what do you think happens this time?

Speaker 5 It's a good question. It's always tricky to guess, but there is a significant likelihood that the court may uphold the tariffs.

Speaker 5 And there are some plausible legal arguments that this case is different.

Speaker 5 First, to the extent that these tariffs implicate the president's foreign policy powers, then there's an argument that Justice Kavanaugh at one point made that, well, the major questions doctrine shouldn't apply in those cases because of the president's constitutional powers.

Speaker 5 I think the other factor that's worth keeping in mind, though, is the Supreme Court's general interest in an expansive conception of the presidency, especially where it concerns the Trump administration.

Speaker 5 What we've seen over the past six months is that the Trump administration has had an astonishing winning streak.

Speaker 5 And so I would not be surprised if the court ultimately concludes that these tariffs are permissible, especially because they may hesitate before stepping into a policy matter of such gravity.

Speaker 5 Right, right.

Speaker 3 I buy that analysis, but

Speaker 3 says the non-lawyer in the conversation, but

Speaker 3 we do remember that the court has been skittish about messing with the economy.

Speaker 3 And I point you to, I forget the name of the case, but where they carved out that exception for the Federal Reserve when talking about the executive's ability to fire heads of agencies.

Speaker 3 So clearly, the court is aware of economic mayhem that may result.

Speaker 5 That's right.

Speaker 5 So the Supreme Court has signaled that it at least has doubts about the president's ability to remove members of the Federal Reserve Board, even though it seems to be okay with the president firing and controlling the heads of other agencies like the National Labor Relations Board.

Speaker 5 So it's true that the court seems to might have some limits.

Speaker 5 I think the best analysis here, though, is not that the court wants to give the president complete carte blanche authority to do whatever he likes.

Speaker 5 What the court wants to do is to make sure that it retains its authority.

Speaker 5 So, you know, there's a lot of talk these days about the unitary executive, this idea that the president has all of the power over the executive branch.

Speaker 5 And Trump has exercised that theory extremely energetically.

Speaker 5 But at the same time, what we've seen is the Supreme Court is retaining the authority to constrain or else to bless those exercises of power.

Speaker 5 So, what I'm seeing emerging is not really a unitary executive, but a binary executive, where the president and the court together become the apex of federal government.

Speaker 3

Constitutional law 101, administrative law as well. You're in marketplace with Blake Emerson.

That's from CLA. Professor Emerson, thanks for your attention, Sherry.

I appreciate it.

Speaker 5 Thanks so much, Kai. Always a pleasure.

Speaker 3 Coming up.

Speaker 8 I would say right now we're not really feeling tariffs.

Speaker 3 The market power of the American consumer. But first, let's do the numbers.

Speaker 3 Dow Industrial is down 251 today, 12%, 47,085. The NASDAQ down 486 points, 2%,

Speaker 3

23,348. You want to talk valuations? That's where you look.

The SP 500 down 80 points, 1.2%,

Speaker 3

6,771. Pizza Hut might be coming up for sale.

Owner Yum Brands is reportedly considering selling off the chain with more than 6,500 locations in these United States.

Speaker 3

Yum Brands heated up 7.3 tenths percent today. Hertz Global Holdings posted its first quarterly profit in two years beating expectations.

The car rental company picked up 36%.

Speaker 3 That's what happens when you make your first profit in two years. You're listening to Marketplace.

Speaker 9 This podcast is brought to you by Wise, the app for international people using money around the globe.

Speaker 9 With Wise, you can send, spend, and receive up to 40 currencies with only a few simple taps and save up to 55% compared to major banks.

Speaker 9 Whether you're buying souvenirs with pesos in Puerto Vallarta or sending Euros to a loved one in Paris, you know you're getting a fair exchange rate with no extra markups.

Speaker 9 That's what makes WISE the fast, affordable way to use your money around the globe.

Speaker 9 WISE offers 24-7 live support and runs over 7 million daily checks to catch and prevent fraud, so you know your money is where it's supposed to be. Be smart.

Speaker 9

Join the 15 million customers who choose WISE. Download the WISE app today or visit Wise.com.

Learn more by visiting wise.com/slash US slash compare. T's and C's apply.

Speaker 2 This podcast is supported by Odo. Some say Odo business management software is like fertilizer for businesses because the simple, efficient software promotes growth.

Speaker 2 Others say Odoo is like a magic beanstalk because it scales with you and is magically affordable.

Speaker 2 And some describe Odoo's programs for manufacturing, accounting, and more as building blocks for creating a custom software suite. So Odoo is fertilizer, magic beanstock building blocks for business.

Speaker 2

Odoo, exactly what businesses need. Sign up at odoo.com.

That's odoo.com.

Speaker 4 This marketplace podcast is supported by Wealth Enhancement, who ask, do you have a blueprint for your money?

Speaker 4 Wealth Enhancement can help you build the right blueprint for investing, retirement, tax, and more.

Speaker 4 With offices nationwide, there's an advisor who's ready to listen and craft a blueprint for your future. Find out more at wealthenhancement.com/slash build.

Speaker 9 Fifth Third Bank's commercial payments are fast and efficient, but they're not just fast and efficient, they're also powered by the latest in payments technology built to evolve with your business.

Speaker 9 Fifth Third Bank has the Big Bank Muscle to handle payments for businesses of any size, but they also have the FinTech Hustle that got them named one of America's most innovative companies by Fortune magazine.

Speaker 9

That's what being a Fifth Third Better is all about. It's not about being just one thing, but many things for our customers.

Big Bank Muscle, FinTech Hustle.

Speaker 9 That's your commercial payments, a fifth-third better.

Speaker 3 This is Marketplace. I'm Kai Rizdahl.

Speaker 3 If the Supreme Court decides President Trump's reciprocal tariffs are not in fact legal, that he has abused the International Emergency Economic Powers Act, the federal government's going to be on the hook for give or take $90 billion in refunds.

Speaker 3 How's that going to work, do you suppose?

Speaker 3 Justin Ho reports now from the marketplace desk of, huh, bureaucracy.

Speaker 10 Refunds are actually pretty common in the customs world. For instance, if a company accidentally pays too much in tariffs, it can ask customs and border protection to give that money back.

Speaker 11 You have to provide the evidence that maybe you filed under the wrong code and you feel like you're owed a refund.

Speaker 10

That's Ryan Peterson. He's a CEO of Flexport, a supply chain management firm that helps companies request tariff refunds.

Peterson says the process normally takes six to nine months.

Speaker 11 It'll depend on how good your case is and if your paperwork is clear and if they ask follow-up questions and push on it and stuff like that.

Speaker 10 So if the government has to repay $90 billion worth of tariffs, the backlog could pile up. Rachel Brewster is a professor at Duke Law School.

Speaker 14 So I think that the most likely approach would be like, all right, well, there's a legal process for this.

Speaker 14 Everyone, get your receipts, find our forms, file the forms, dot all the I's, cross all the T's.

Speaker 10 Brewster says that takes time and resources.

Speaker 14 And you could imagine that for some small businesses who are really being hurt by the tariffs, the idea of kind of hiring the lawyers or the accountants to put together the records to get that money back might simply not be a cost-benefit proposition.

Speaker 10 Having to pay back all of those tariffs would also have consequences for the Treasury Department.

Speaker 12 The Treasury likely doesn't have that type of money on hand.

Speaker 10 Lawrence Gillam is chief fixed income strategist at LPL Financial. He says the government would likely raise that money by auctioning off short-term bonds.

Speaker 12 And then you would have to have market participants buy those treasuries and kind of satisfy that new supply in the market.

Speaker 10 And demand for those bonds isn't guaranteed.

Speaker 12 There's been times where these auctions haven't been great, and there's been times where these auctions have been really great. So it's kind of hard to say that definitively that this will go well.

Speaker 10 And if it doesn't, the interest the government pays could rise. I'm Justin Howe for Marketplace.

Speaker 3 So let's say the Supreme Court rules President Trump's IEPA tariffs do in fact violate the law.

Speaker 3 The president, being a tariff man, those those are his words, he is almost certainly looking for other options. And it turns out he's got lots of them.

Speaker 3 Marketplace to Sabri Benishore has more on all the president's Plan Bs.

Speaker 13

A few years ago, Zach Hubert noticed a problem. Chinese pea protein was flooding the U.S.

market at insanely low prices.

Speaker 15 They were selling it for 30 to 40 percent the cost to manufacture that same pea protein.

Speaker 13 Hubert is corporate development manager at Minnesota-based Puris, which manufactures pea protein that goes into shakes and bars and pet food. Puris was losing business, so it petitioned the U.S.

Speaker 13 government for help and got it.

Speaker 15 The U.S. International Trade Commission imposed duties ranging from 127% to 626% on all imports of pea protein from China.

Speaker 13

These are anti-dumping and countervailing duties. They are the most surgical tariffs there are.

They can be specific to individual companies or products.

Speaker 14 The next bigger level is where we generally go after a country.

Speaker 13 Nicole Bivens Collinson heads international trade and government relations at Sandler, Travis, and Rosenberg.

Speaker 13 If a whole country has shady trade practices like stealing technology, there's a tariff for that. It was used against China in the first Trump administration.

Speaker 13 The president can also dust off tariffs from as far back as 1930 that have never or rarely been used. There's Section 338 tariffs for when countries discriminate against the U.S.

Speaker 13 Section 122 tariffs if there's an economic crisis around trade or currency flows.

Speaker 3 But wait, there's more.

Speaker 14 If the president believes that there are certain imports that are entering the United States that threaten our national security, then you can take action as well.

Speaker 13

These national security tariffs apply to a whole industry across all countries. They're currently on steel and aluminum.

They first require an investigation, and there are many of those on the way.

Speaker 14 We've got investigations on pharmaceuticals, on semiconductors, drones, wind turbines in their parts.

Speaker 13 That is a very partial list, by the way.

Speaker 13 Most of these Plan B tariffs require investigations or have time limits on them or eventually need authorization from Congress, which is probably why they were not President Trump's first choice, but he has options.

Speaker 13 In New York, I'm Sabri Benishore for Marketplace.

Speaker 3 We got a whole lot of questions from all y'all about tariffs, so I answered some of them. They're on our Instagram at MarketplaceAPN.

Speaker 3 Tariffs, just because you can't say it too many times, are taxes paid in the main by consumers.

Speaker 3 However, comma, there are times when the American consumer specifically is so valuable to a country or an industry that those tariff costs are not explicitly passed along as they normally would be.

Speaker 3

Does it happen a lot? Probably not, but it does happen. Johanna Dominguez is the owner of Put a Plant On It.

She's in Buffalo, New York.

Speaker 8 I would say right now we're not really feeling tariffs. We have four growers that we work with in Canada, and it's something like 98 or 99.8% of Canada's green industry is all to the United States.

Speaker 8 So if they didn't have the United States as a buyer, then they would have nowhere to sell it. One of our growers has split the tariffs.

Speaker 8 So one is doing 12.5 of the cost of the tariffs are going to them and then 12.5 are going to us.

Speaker 8 And then all the other three growers that we get stuff from Canada have decided to not implement the tariffs on us.

Speaker 8

There has been some border issues recently. There's been some times where it's been taking longer to cross the border.

The computers were down for two or three days.

Speaker 8 I want to say about a couple weeks ago.

Speaker 8 So, one of the changes that we've done for the most part is getting more of our plants from Florida and just skipping out on Canada altogether just because of the unpredictability.

Speaker 8 So, as a business owner, I would say that is the part that's been the most stressful:

Speaker 8 you know, the on again, off again, and like what's happening tomorrow, what's happening today.

Speaker 8 But right now, it's just you know, pretty much a holding pattern to see what is going to happen.

Speaker 3 What indeed Johanna Dominguez, she owns, put a plant on it. It's a store in Buffalo, New York.

Speaker 3 This final note on the way out today, another entry in the economic data we did not get file of interest perhaps given the hearing in the Supreme Court tomorrow.

Speaker 3 We were supposed to be told by the Census Bureau this morning how much more we bought from overseas than we sold internationally. That's the trade gap, in other words.

Speaker 3 And it is the basis, as I mentioned, for the emergency at issue in that AIPA case. Last data we have is from August.

Speaker 3

Jordan Manji, Sunil Maharaj, Janet Wynn, Olga Oxman, Virginia K. Smith, and Tony Wagner are the digital team.

I'm Kyle Rizdo. We will see you tomorrow, everybody.

Speaker 3 This is APM.

Speaker 16 Ever see an idea so clearly in your head but struggle to find the time to get it all done? Wix helps you go from, eh, I'll get to it, to done.

Speaker 16 Build a full site just by describing your idea.

Speaker 16 Let an AI agent handle daily tasks, plan your next marketing campaign, or help out customers so you can grow your business the way you want without it taking over your life. Try it out at Wix.com.